New Venture Fund [Arabella Advisors]

| URL |

https://Persagen.com/docs/new_venture_fund.html |

| Sources |

Persagen.com | other sources (cited in situ) |

| Date published |

2021-09-02 |

| Curation date |

2021-09-02 |

| Curator |

Dr. Victoria A. Stuart, Ph.D. |

| Modified |

|

| Editorial practice |

Refer here | Dates: yyyy-mm-dd |

| Summary |

The New Venture Fund (NVF) is a 501(c)(3) funding and fiscal sponsorship nonprofit that makes grants to left-of-center advocacy and organizing projects and provides incubation serves for other left-of-center organizations. NVF focuses primarily on social and environmental change, issuing grants for a variety of projects that include conservation, global health, disaster recovery, education, and the arts. NVF is the largest 501(c)(3) nonprofit in the network of four nonprofits created and managed by Arabella Advisors, a Washington, D.C.-based philanthropy consulting company that caters to major foundations and organizations on the political Left. |

| Self-reported summary |

Show

"We manage a charitable portfolio of more than $356 million across nine regions around the globe." "We solve problems creatively by building on an established model known as fiscal sponsorship." "Our team of creative problem-solvers provides strategic advice and operational support to a range of donor-supported projects in conservation, education, youth development, global health, public policy, global development, disaster recovery, and the arts." "... we know that advancing race equity, equity, diversity and inclusion (REDI) is essential to solving our world's most pressing problems. As such, we dedicate ourselves to integrating REDI into our work and our culture." More than half of the 50 largest US grant-making foundations have funded projects hosted at the New Venture Fund, including eight of the top 10. "From 2013-2108, we: We are a 501(c)(3) public charity overseen by an independent board of directors with extensive experience in philanthropy and nonprofit management. To increase our own efficiency and effectiveness, NVF employs a team from Arabella Advisors to manage many of our day-to-day operations. Arabella is a leading philanthropy services firm that provides expert support to a wide range of foundations, impact investors, individual philanthropists, and nonprofit organizations. Source: New Venture Fund: here, here, and here.

|

| Main article |

Arabella Advisors (parent organization of New Venture Fund)

|

| Related |

SAGE Fund (project of New Venture Fund) |

|

| Keywords |

Show

|

| Named entities |

Show

|

| Ontologies |

Show

- Science - Social sciences - Economics - Economic systems - Capitalism - Advocacy - Lobbying - Advocacy groups - Secretive advocacy groups

- Science - Social sciences - Economics - Economic systems - Capitalism - Advocacy - Lobbying - Advocacy groups - Secretive advocacy - Dark money

- Society - Charitable giving & Practices - Politics - Countries - United States - Organizations - Nonprofit organizations - 501(c)(3) organizations - New Venture Fund

- Society - Charitable giving & Practices - Politics - Countries - United States - Organizations - Nonprofit organizations - 501(c)(4) organizations - Americans for Tax Fairness Action Fund

- Society - Charitable giving & Practices - Politics - Organizations - Nonprofit Organizations - Dark money - Countries - United States - Donor-advised funds

- Society - Charitable giving & Practices - Politics - Organizations - Nonprofit Organizations - Dark money - Countries - United States - Donor-advised funds - Arabella Advisors

- Society - Charitable giving & Practices - Politics - Organizations - Nonprofit Organizations - Dark money - Countries - United States - Donor-advised funds - Arabella Advisors - New Venture Fund

- Society - Charitable giving & Practices - Politics - Organizations - Nonprofit Organizations - Dark money - Countries - United States - Donor-advised funds - Arabella Advisors - New Venture Fund - Americans for Tax Fairness

|

New Venture Fund

|

| Name |

New Venture Fund |

| Abbreviation |

NVF |

| Former name |

Arabella Legacy Fund (2006-2009) |

| Managed by |

Arabella Advisors |

| Founded |

2006-10 |

| Founders |

Eric Kessler |

| President |

Lee Bodner |

| Former president |

Eric Kessler (2006-2015) |

| Executives |

|

| Board of Trustees |

|

| Other key staff |

|

| Type |

501(c)(3) nonprofit organization |

| EIN (Tax ID) |

20-5806345 |

| Location |

Washington, D.C., USA |

| Areas served |

Global |

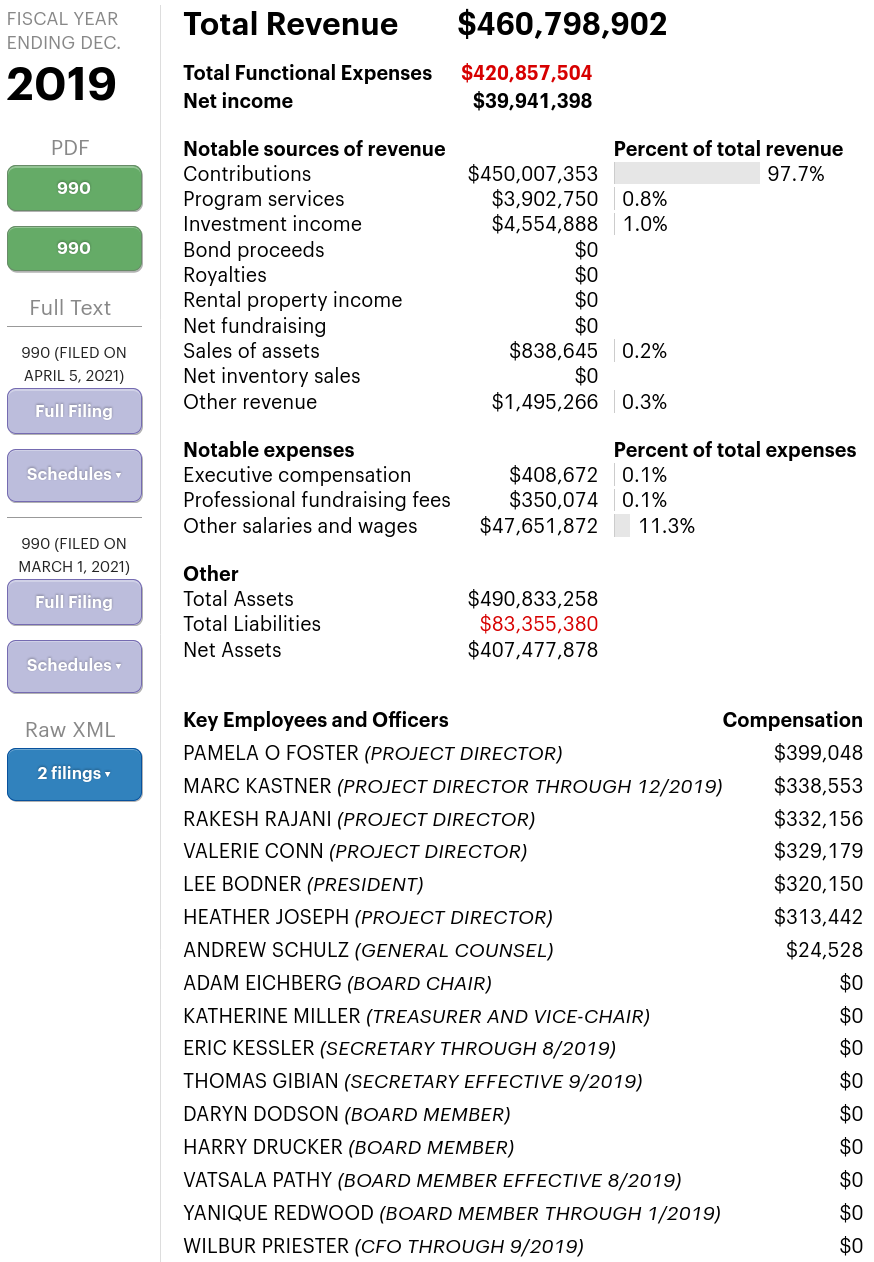

| Financials |

Year | Total Revenue | Total Expenses | Net Assets

2019 | $460,798,902 | $420,857,504 | $407,477,878

2018 | $405,281,263 | $373,007,693 | $371,491,214

2017 | $358,858,641 | $329,784,536 | $339,217,644

2016 | $357,581,316 | $264,546,947 | $321,816,285

2015 | $318,405,056 | $214,351,188 | $230,092,075

|

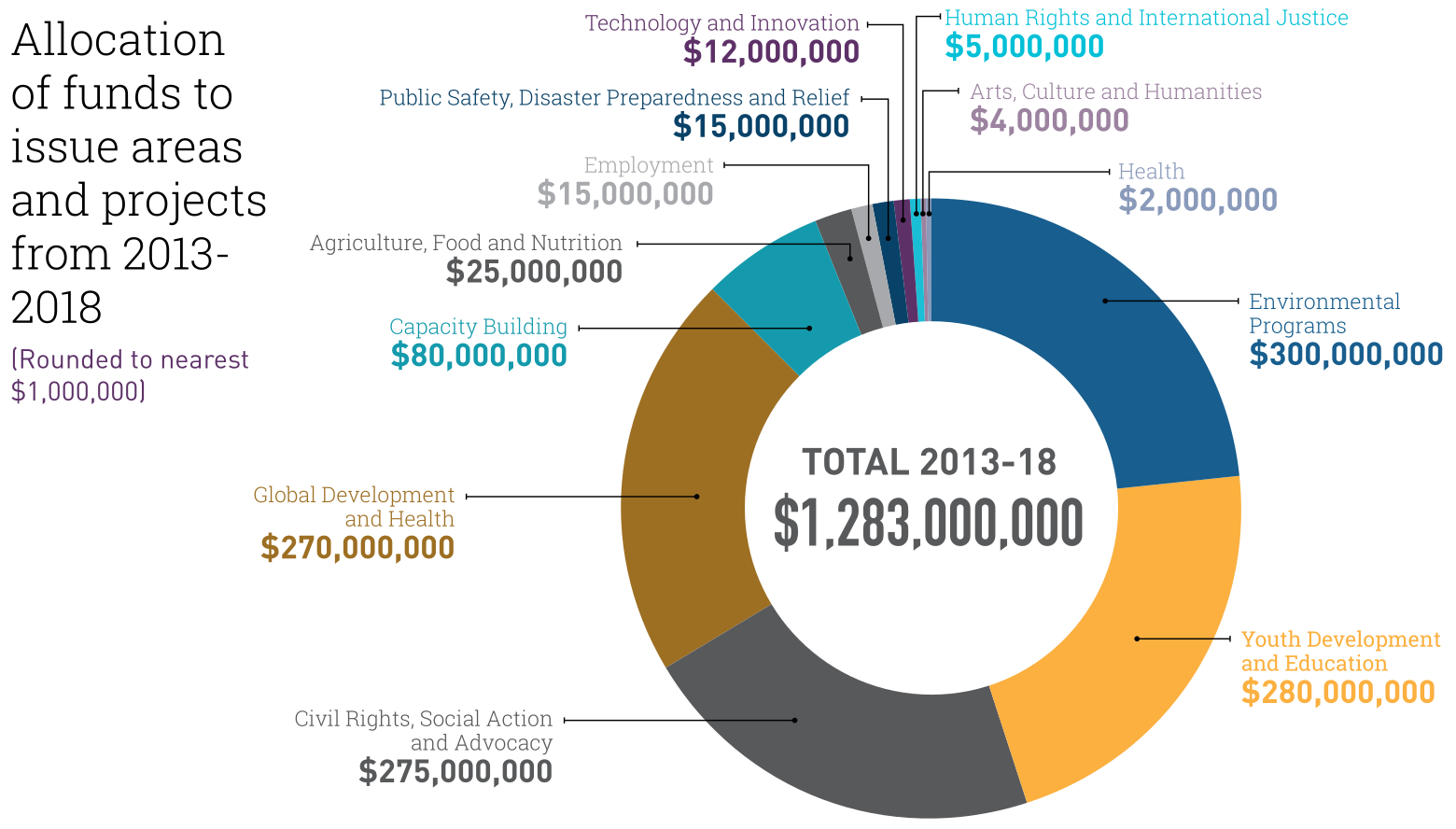

Project funding,

2013-2018 |

$1,283,000,000:

- $300,000,000 : Environment

- $280,000,000 : Youth development, education

- $275,000,000 : Civil rights, social action

- $270,000,000 : Global development, health

- $80,000,000 : Capacity building

- $25,000,000 : Agriculture, nutrition

- $53,000,000 : Other

|

| Description |

The New Venture Fund, a left-wing organization, is the largest and oldest of the Arabella Funds. The New Venture Fund's donors are generally major private foundations and donor-advised fund providers (whose funds typically originate with individual donors). |

| Known for |

|

| Vendors, Consultants |

|

| Website |

NewVentureFund.org |

Context

Arabella Advisors is a Washington, D.C.-based for-profit company that advises left-leaning donors and nonprofits about where to give money and serves as the hub of a politically liberal "dark money" network. It was founded by former Clinton administration appointee Eric Kessler.

Organizations incubated by and affiliated with Arabella Advisors include the Sixteen Thirty Fund, the New Venture Fund, the Hopewell Fund, and the Windward Fund. These groups have been active in various efforts to oppose the Trump administration and to organize opposition to numerous Republican Party politicians and policies. Because of the way they are legally structured, Arabella Advisors and its affiliated groups are not required to disclose their donors, and they have not opted to do so.

Source for the following paragraph: Wikipedia, 2021-09-10

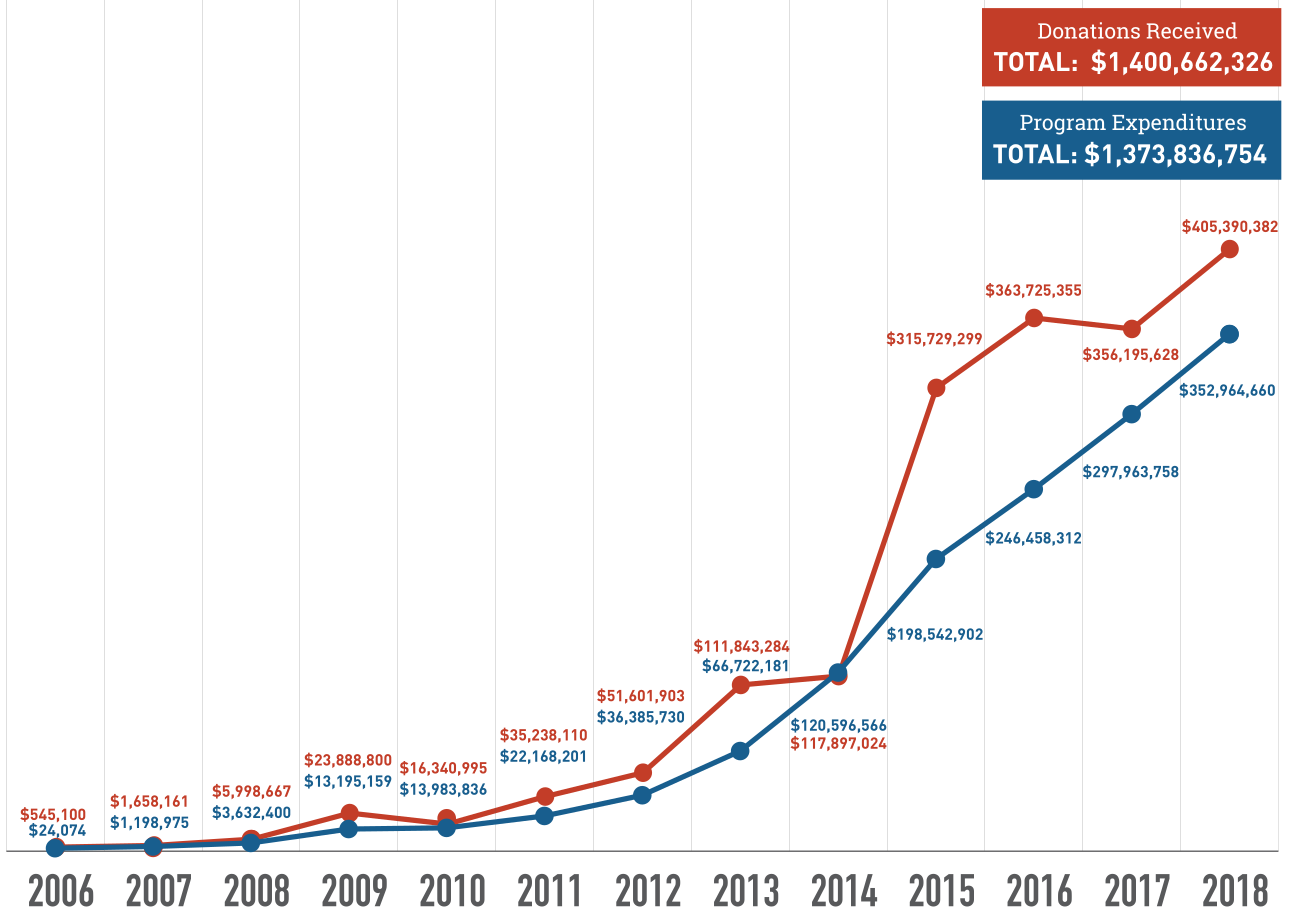

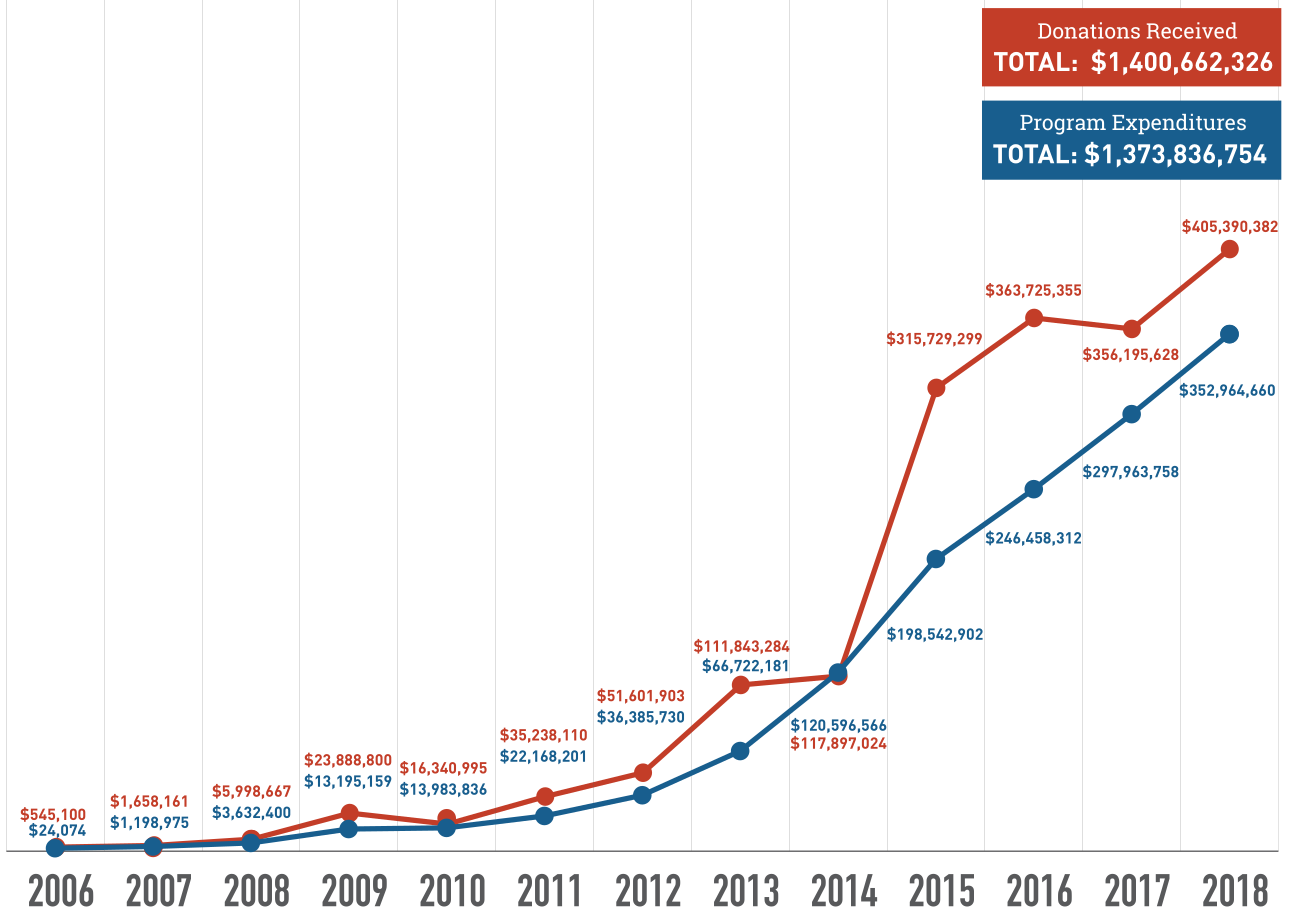

The New Venture Fund had revenue of $405 million in 2018, up from $350 million annually in the three preceding years. According to the Center for Responsive Politics, the New Venture Fund "has fiscally sponsored at least 80 groups and acted as a pass-through agency funneling millions of dollars in grants for wealthy donors to opaque groups with minimal disclosure."

Background

The New Venture Fund (NVF) is a 501(c)(3) funding and fiscal sponsorship nonprofit that makes grants to left-of-center advocacy and organizing projects and provides incubation serves for other left-of-center organizations. The fund focuses primarily on social and environmental change, issuing grants for a variety of projects that include conservation, global health, disaster recovery, education, and the arts. NVF is the largest 501(c)(3) nonprofit in the network of four nonprofits created and managed by Arabella Advisors, a Washington, D.C.-based philanthropy consulting company that caters to major foundations and organizations on the political Left.

The Hopewell Fund and the Windward Fund are also 501(c)(3) nonprofits managed by Arabella Advisors that work closely with New Venture Fund and Sixteen Thirty Fund.

Source for the following paragraphs: New Venture Fund (NVF)'s 2019-12 impact report, New Venture Fund: Using Philanthropy to Shape a More Just, Equitable and Sustainable Future | local copy.

"New Venture Fund (NVF) was established in 2006 as a 501(c)(3) public charity to support innovative social entrepreneurs and nonprofit organizations seeking to address society's most pressing needs. ...

"NVF partners with philanthropists, change-makers and disruptors to build a fair, healthy and sustainable world for all people. ... We host projects that tackle the structural causes of inequality and environmental degradation ... [ see also structural violence.]

"At NVF we are steadfast in our support of racial equality and gender equity. Our goal is to foster robust cultures of safety, respect, fairness and accountability, while helping our projects adopt an ethos of continuous improvement that is reflected in their daily work. ... [We] built an organization that brings resources and expertise to social entrepreneurs and nonprofits quickly, harnessing all we know to move from talking about change efforts we want to see to seeing changes happening on the ground. Instead of leaders struggling to learn accounting systems, HR and funding databases, they got to focus on what they are best at: standing up visionary efforts, activating support and building momentum.

"NVF's expertise starts with an independent board of directors that has extensive experience in philanthropic and nonprofit management. ..."

Founding

See also: Eric Kessler.

The New Venture Fund was created on 2006-10-25 in the District of Columbia as the Arabella Legacy Fund; the 501(c)(3) nonprofit received IRS recognition of its tax exemption in January 2007. On 2009-10-20, the Arabella Legacy Fund was officially renamed the New Venture Fund [source].

At the time of its formation, Eric Kessler served as President of the Arabella Legacy Fund. Kessler is the Founder and Senior Managing Partner of Arabella Advisors, a philanthropy consulting firm headquartered in Washington, D.C. The Arabella Legacy Fund's founding Board of Directors in 2006-2007 consisted of Kessler, then-Illinois Nature Conservancy Executive Director Bruce Boyd, and then-Western Conservation Foundation Executive Director Adam Eichberg.

Projects

Project: Fix the Court

Source: Wikipedia

The New Venture Fund provides all of the funding for Fix the Court, a judicial advocacy group that seeks reform of the U.S. federal court system. When Brett Kavanaugh was nominated to the U.S. Supreme Court, Fix the Court bought several Internet domain names related to Brett Kavanaugh and redirected them to websites including End Rape On Campus, the National Sexual Violence Resource Center, and the Rape, Abuse & Incest National Network. Fix the Court's Executive Director, Gabe Roth, said he purchased and redirected the websites because he believed the sexual assault allegations made by Christine Blasey Ford against Brett Kavanaugh, and by Anita Hill against Clarence Thomas. [ see also Supreme Court of the United States.]

Leadership

Executives

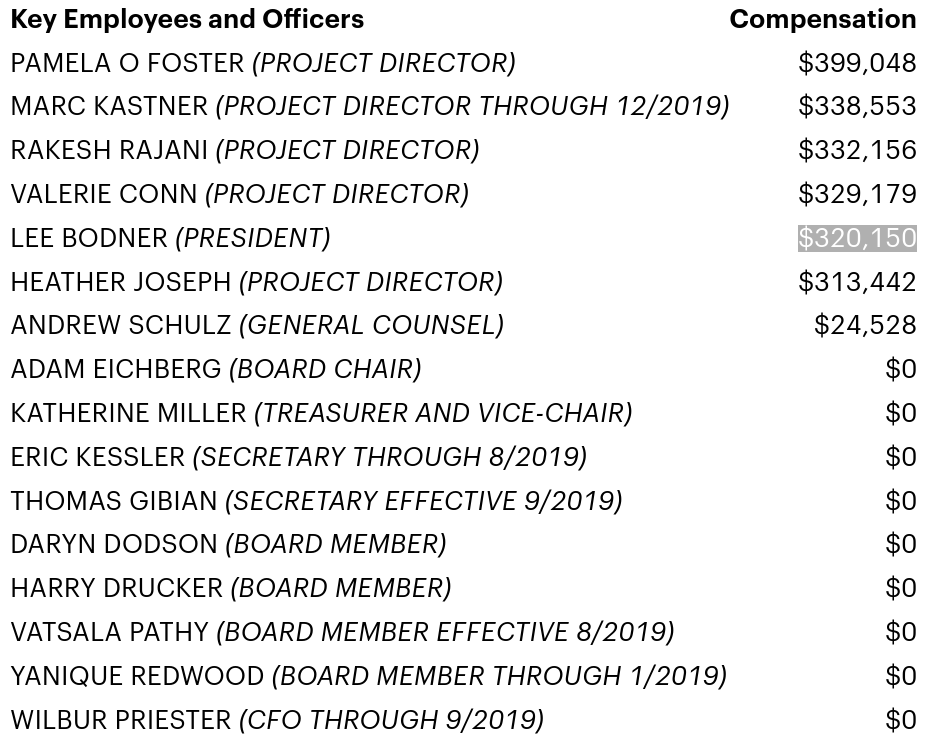

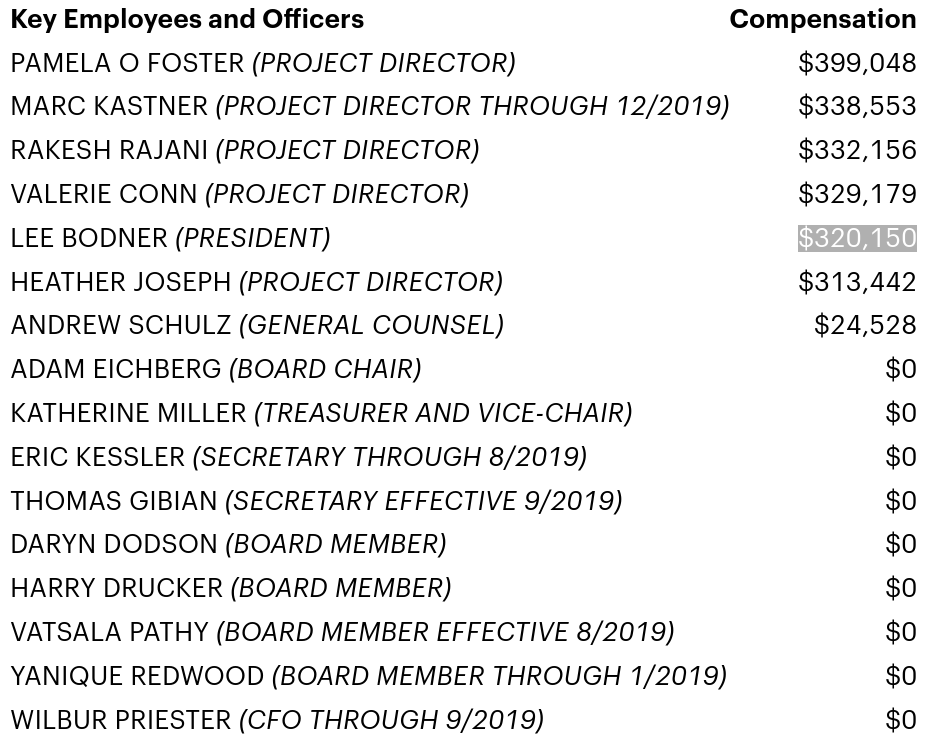

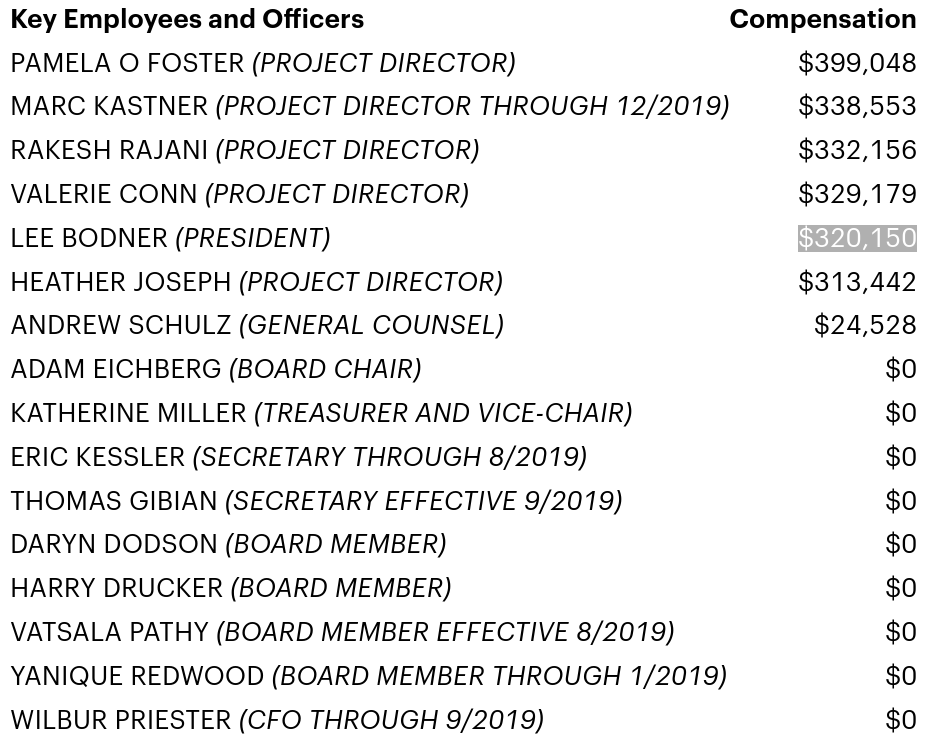

See "Part VII: Compensation of Officers, Directors, Trustees, Key Employees, Highest Compensated Employees, and Independent Contractors" in New Venture Fund's IRS Form 990 filings for listings of Executives, Board of Directors, and their compensation.

New Venture Fund: Executive and Board of Directors compensation, 2019

New Venture Fund: Executive and Board of Directors compensation, 2019

[Source]

Lee Bodner, President

Lee Bodner is President of New Venture Fund, and is a former Managing Director for Arabella Advisors, leading its engagement with the New Venture Fund and many national nonprofit organizations that Arabella has managed, including the Sixteen Thirty Fund, the Latino Victory Project, and others. Bodner received total compensation of $384,144 in 2019.

Lee Bodner brings to the New Venture Fund more than 20 years of experience incubating and launching innovative partnerships with the public, private, and nonprofit sectors. He was founding Executive Director of ecoAmerica, a nonprofit focusing on educating the American public on conservation issues. While there, Bodner helped launch the American College and University Presidents' Climate Commitment, which put the fight against climate change at the center of higher education's agenda. Lee also built strategic partnerships with nonprofits, including the Clinton Foundation, and The Nature Conservancy.

Previously, Lee Bodner led a 40-person project team at D&R International, which established ENERGY STAR as an internationally recognized brand name for energy-efficient consumer products. Lee and his team worked in support of the United States Environmental Protection Agency and Department of Energy to convince companies like Sears, The Home Depot, Whirlpool, and GE to use the ENERGY STAR label. Lee serves as Chair of the Board at two other independent nonprofits originally incubated at the New Venture Fund: the Windward Fund, and the Hopewell Fund. Lee Bodner earned a B.A. from Wesleyan University and an M.B.A. from Georgetown University.

Kathleen Flynn, Chief Operating Officer

Source for this subsection: New Venture Fund.

As the Chief Operating Officer, Kathleen Flynn uses her 17 years of experience with nonprofit operations to manage the 's strategic planning process, and oversee implementation of the organization's strategic goals. She directs the New Venture Fund's non-financial operations, including human resources, compliance, and project management, coordinating closely with Arabella Advisors and other contractors. Her role also includes compliance responsibilities that mitigate risk for this large nonprofit fiscal sponsor as it supports innovative public-interest projects, donor collaboratives, and grant-making programs. Additionally, Kathleen ensures that employees and contractors comply with laws, regulations, and policies by providing technical assistance and leading the development of systems and tools.

Prior to joining the New Venture Fund, Kathleen Flynn was a Senior Director at Arabella Advisors, helping to manage several nonprofits, including the Sixteen Thirty Fund, a 501(c)(4) organization. For over four years, Kathleen was the Planning and Operations Manager for the Pew Research Center's Religion & Public Life Project, where she managed finances, contracts, and grants. Kathleen also spent six years as the Director of Finance and Operations at the Dee Norton Lowcountry Children's Center, a nonprofit in Charleston, SC that provides services to child abuse victims and their families.

In a previous life, Kathleen Flynn was a news researcher at the Atlanta Journal-Constitution, and U.S. News & World Report. She managed people and projects to support the information needs of journalists and corporate executives. Kathleen has volunteered with several nonprofits, including serving on their boards. Kathleen has a B.A. in history from Georgetown University, and an MA in library science from the University of Maryland.

Shannon Scott, Chief Financial Officer

Source for this subsection: New Venture Fund.

Shannon Scott provides strategic and administrative leadership to effectively serve as a thoughtful business partner to the New Venture Fund's leadership team regarding the short-term and long-term financial health and sustainability of the New Venture Fund. She translates the New Venture Fund's strategic vision into a financial and operational structure that is fiscally responsible and supportive of the mission. Additionally, she works closely with the New Venture Fund's Board of Directors, oversees external partnerships with banking and accounting providers, manages the New Venture Fund board's finance committee, and represents the New Venture Fund in conversations with donors and project staff.

Prior to joining the New Venture Fund, Shannon Scott spent over four years at the Greater Washington Community Foundation, where she also served as Chief Financial Officer and set financial policy and strategy. She also served as Chief Financial Officer at the National Housing Trust, and the Council on Foundations, and spent over 12 years at Capital Impact Partners, a community development financial institution providing capital and technical assistance for community groups.

Shannon Scott holds a B.A. in accounting from George Washington University and an M.B.A. in finance from the University of Maryland's Robert H. Smith School of Business. Additionally, Shannon owns a photography business.

Andrew Schulz, General Counsel

Source for this subsection: New Venture Fund.

Andrew Schulz is general counsel for New Venture Fund (NVF), as well as Arabella Advisors and its three "sister" nonprofits. In 2019, his total compensation from NVF was $24,528.

Andrew Schulz is responsible for the New Venture Fund's legal compliance, and for providing expert guidance to the firm and its many hosted projects on a broad cross-section of tax, legislative, and regulatory issues. Andrew has over 17 years of experience representing nonprofits and is deeply knowledgeable on the many legal issues relating to the governance and management of charitable organizations, including federal income tax, grant making, lobbying, political activity, endowment management, fiscal sponsorship, charitable giving, nonprofit corporations, contracts, copyright, trademark, and employment law.

Previously, Andrew was Executive Vice President at Foundation Source, serving the company's more than 1,100 family and corporate foundation clients. He also represented the company within policy, legislative, and regulatory circles, and worked to cultivate relationships between the firm and attorneys, advisors, nonprofit partners, and other philanthropy service firms.

Andrew may be best known for his over 12 years of experience at the Council on Foundations. While there, he held numerous roles, most recently leading the council's government relations and advocacy efforts as Vice President, Legal and Public Policy. He also served as in-house counsel, educating council members on legal issues that affected their operations; administering the council's governance functions; serving as the lead staff member on matters of ethics and best practices; and ensuring organizational compliance with state, local, and federal laws. Among his accomplishments while at the Council on Foundations, Andrew is most proud of the roles he played in designing and implementing an ethical code and sanctions process for members, and developing and rolling out the National Standards for U.S. Community Foundations.

A nationally recognized authority on private foundations, Andrew is a frequent speaker and occasional author on various topics related to the philanthropic sector. He is a graduate of the College of Wooster and has a J.D. with honors from the George Washington University Law School. He is a member of the Maryland and District of Columbia bars. He has served on many nonprofit boards both as a director and as pro bono counsel. He lives in Kensington, MD with his wife and two children.

Board of Directors

Source for this subsection: New Venture Fund | local copy, 2021-09-10

Compensation (2019): $0 [source]

New Venture Fund: Executive and Board of Directors compensation, 2019

New Venture Fund: Executive and Board of Directors compensation, 2019

[Source]

Adam Eichberg, Chair of the Board

There aren't too many people in Colorado who can claim their family goes back four generations, but Adam Eichberg's family has had feet planted on Colorado's soil since the 1880s. That's when Adam's great-great grandfather, a physician, moved to Denver to treat patients suffering from tuberculosis. By the time Adam came along, his connection to the state was very deep. As a kid, Adam spent his summers at a camp at the base of Mount Evans. During the winters, he skied the moguls at Winter Park as a not-so-competitive racer, and when it came time for college, he stayed put, enrolling at the University of Colorado, where he studied environmental conservation.

Realizing that the natural environment where he'd grown up could be threatened, Adam Eichberg got involved with political campaigns after graduation, and then took a job as a strategic consultant for one of the nation's largest conservation groups [see, e.g., Headwaters Strategies]. There, he helped pass legislation and ballot measures providing more than $14 billion in capital funding for parks and open spaces. After that, Adam created and ran a multi-million dollar foundation dedicated to funding innovative approaches to aid state and federal policy campaigns.

Realizing that the natural environment where he'd grown up could be threatened, Adam Eichberg got involved with political campaigns after graduation, and then took a job as a strategic consultant for one of the nation's largest conservation groups. There, he helped pass legislation and ballot measures providing more than $14 billion in capital funding for parks and open spaces. After that, Adam created and ran a multi-million dollar foundation dedicated to funding innovative approaches to aid state and federal policy campaigns.

"Throughout my career, I've been lucky to work on issues I care deeply about, issues that impact the state I love and make it the kind of place I want to raise my family," he says. Today, Adam's kids enjoy some of the same things Adam did when he was younger, including the skiing program at Winter Park. Beyond skiing with his wife and kids, Adam loves to ride anything with two wheels on the road, in the dirt, or on the cyclocross course.

Adam Eichberg is the current Chair of the Board for nonprofit group New Venture Fund, and was one of the founding Board Members of nonprofit Windward Fund. Both New Venture Fund and Windward Fund are nonprofits managed by philanthropic consulting firm Arabella Advisors. Previously, Adam Eichberg was the co-founder of the environmental consulting firm Headwaters Strategies, the deputy legislative director for Colorado governor Bill Ritter (D-CO), and the Director of Policy, External Affairs, and Planning at the Colorado Department of Public Health and Environment.

LittleSis.org profile | local copy

Adam Eichberg is a principal and founder of Headwaters Strategies, a dynamic public affairs consulting firm in Denver, Colorado. An experienced strategist, Adam has extensive expertise in civil justice, regulatory, and natural resource issues.

Before founding Headwaters Strategies in 2009, Adam Eichberg concurrently served as the deputy legislative director for Governor Bill Ritter, and the director of policy, external affairs, and planning at the Colorado Department of Public Health and Environment.

Adam Eichberg came to the Ritter Administration from the Western Conservation Foundation, having served as the foundation's first Executive Director from April of 2005. From 1999 until March 2005, Adam served as the Associate National Director of The Trust for Public Land's conservation finance program, where he helped to pass measures providing more than $14 billion in parks and open space capital funding. Prior to his appointment with The Trust for Public Land, Adam served as a strategic communications consultant with a private Denver-based firm. A political and nonprofit veteran, Adam has been involved in hundreds of legislative, ballot measure, and candidate campaigns at the local, state, and national level. A graduate of the University of Colorado, Adam is a fourth-generation Coloradoan and currently lives in Denver wife his wife and two young children.

Daryn Dodson, Managing Director

Daryn Dodson is a passionate advocate of social and economic justice, especially for disadvantaged and marginalized groups. His work with impact investors, private equity funds, Fortune 100 companies, universities, and foundations has helped address the world's most pressing social and environmental problems.

Daryn Dodson is the founder and Managing Director of Illumen Capital, impact funds that seeks to increase gender and racial equity within financial markets. Illumen Capital invests in top growth, private equity, and venture impact funds, and then provides coaching and tools to fund managers designed to reduce implicit bias. Daryn previously led the Special Equities Program as a consultant to the board of the Calvert Funds, a $15 billion pioneer of the impact investing field. Through this vehicle, Calvert Funds maintains a portfolio of more than 40 funds on five continents, representing over 350 underlying portfolio companies. Prior to serving as a consultant to Calvert Funds, Daryn served as Director of University and Corporate Partnership for The Idea Village, where he created a platform engaging leading private equity firms, business schools, and Fortune 500 companies to invest over 100,000 hours and $2 million into more than 1,000 New Orleans entrepreneurs post-Hurricane Katrina.

Daryn Dodson is the co-author of published research that examines the influence of race in financial judgements of asset allocators [Sarah Lyons-Padilla et al. (2019) "Race influences professional investors' financial judgments," Proceedings of the National Academies of the USA | discussion ; local copy], and currently serves on the Board of Directors for Ben and Jerry's. He earned his M.B.A. from Stanford University, where he serves on the Dean's Management Board, and his A.B. from Duke University.

Harry W. Drucker, Managing Partner, North Shore Realty Partners

Harry W. Drucker, Managing Partner, North Shore Realty Partners

[Source]

Harry W. Drucker is Managing Partner of North Shore Realty Partners, a diversified real estate investment platform for family offices.

A lifelong advocate for conservation, Harry Drucker became a trustee of The Nature Conservancy-Illinois (TNC) in 1995 (Chair 2013-2014, voted Life Trustee in 2018). TNC works to conserve the lands and waters on which all life depends.

In 1996, Harry Drucker founded the Friends of the Depot, where he successfully advocated for the addition of thousands of acres to the Upper Mississippi River National Wildlife and Fish Refuge, and prevented the destruction of a pristine sand prairie by promoting an alternative, environmentally appropriate site for construction of a prison.

In 2001, the Governor of Illinois appointed Harry Drucker to the Illinois Nature Preserves Commission. He served as Commissioner until 2010 (Chair 2004-2006). In 2003, he became a Director of the Environmental Law and Policy Center (Wikipedia entry) (Chair 2008-2011 and 2017-present). Believing environmental progress and economic development can be achieved together, Environmental Law and Policy Center develops and leads advocacy campaigns to improve environmental quality and protect natural resources.

In 2008, Harry Drucker joined the Board of the New Venture Fund. In 2015 Harry became a founding Director of the Windward Fund, a charity focused on projects promoting conservation, sustainable food systems, and environmental policy.

Harry Drucker graduated with a Bachelor of Arts, summa cum laude, from Middlebury College in Vermont, and has an M.B.A. in finance from the University of Chicago Graduate School of Business.

Thomas Gibian, Secretary

Thomas "Tom" Gibian retired in 2020 as the Head of School for the Sandy Spring Friends School, a PK-12 college preparatory day school with an optional boarding program located in Sandy Spring, Maryland. He had served as Head since July 2010, prior to which he was one of the school's trustees (1996-2004) and a school clerk (2002-2004). Before he became Head of School at Sandy Spring Friends School, Tom founded ECP Private Equity [ECP: Emerging Capital Partners], a leading private equity management firm focused exclusively on Africa. Headquartered in Washington, DC, ECP has seven offices across Africa and 20 years of successful investing experience in companies operating in over 40 countries on the continent. As CEO of ECP, Tom assisted in the formation and implementation of ECP's investment strategy and managed key relationships with shareholders and portfolio companies.

Prior to founding ECP, Tom Gibian served as Chief Operating Officer for the AIG African Infrastructure Fund ["Africa Fund I;" succeeded 2006-01-10 by EMP Africa Fund II], managing its daily operations and overseeing the structuring and valuation of investments. From 1995 to 2000, Tom served as a Managing Director in EMP Global's Asia Funds, which managed more than $2.8 billion in capital for investments. [ EMP Global's website, http://empglobal.com/, though online has been devoid of content since ~2019-08; the last archive.org snapshot with page content is 2019-07-25.] Prior to his work with EMP Global's Asia Funds, Tom spent three years as Executive Director and Co-Head of the Structured and Project Finance Group at Goldman Sachs Asia, where he was the firm's senior representative on several groundbreaking transactions in China and Southeast Asia.

Tom Gibian has served on the boards of the New York Stock Exchange (NYSE), Nasdaq, and London-listed companies, and for private companies in Europe, Africa, and Asia. He is presently a trustee for the College of Wooster, the Kendal Corporation, and Partners Global. Tom serves on the Policy Committee for the Friends Committee on National Legislation. He is a trustee for the E.L. Haynes Public Charter School, and Friends Academy.

Sandy Spring Friends School, E.L. Haynes Public Charter School, and Friends Academy are Quaker-affiliated institutions.

Tom Gibian received a Bachelor of Arts with honors from the College of Wooster, and received an M.B.A. in Finance from the University of Pennsylvania's Wharton School of Business.

Katherine Miller, Treasurer

Katherine Miller is an award-winning communications executive and campaign strategist. Since 2012, Katherine's work has focused on the interdisciplinary practices of politics, policy, advocacy, sustainability, and gender bias in the global food system. She developed a series of impact-focused programs for the James Beard Foundation, served as the founding Executive Director for the Chef Action Network [see also Arabella Advisors, and New Venture Fund Founder Eric Kessler, the co-Founder of the Chef Action Network], and developed the Chefs Boot Camp for Policy and Change. She was named as a Grist "Fixer" and one of the most innovative women in food and beverage by Fortune, and Food & Wine magazines.

Katherine Miller has more than three decades of experience managing large teams, designing training programs, leading programmatic evaluations, and building effective campaigns. She has worked with Fortune 100 companies, global philanthropic donors, emerging nonprofits, established campaigns, and everything in between. Katherine is on the Boards of Rape, Abuse & Incest National Network (RAINN; the national sexual assault hotline), and the anti-poverty political action committee ButterflyPAC. She is an active member of Les Dames d'Escoffier, and Women Chefs and Restaurateurs.

Katherine Miller holds an undergraduate degree from Loyola University in New Orleans. She spends a lot of time working on her macarons and bread baking techniques.

Vatsala Pathy, Vice-President, Collective Medical Technologies

Vatsala Pathy, Vice-President, Collective Medical Technologies

[Source]

Vatsala Pathy, Vice President of Regulatory & Government Affairs at Collective Medical Technologies [corporate info], has over two decades of experience working with a wide variety of public- and private-sector stakeholders on policy, programmatic, and strategic issues in healthcare delivery, health information technology, and public health.

From 2016 to 2018, Vatsala Pathy served as a Senior Advisor at the Center for Medicare and Medicaid Innovation. Prior to that, she was the Director of the State Innovation Model (SIM) in the Office of [former] Governor John Hickenlooper (current U.S. Senator, D-CO). While in her role as SIM Director, her work transformed Colorado state healthcare, impacting over 70% of the state's population. In 2016, [then] Colorado Governor Hickenlooper honored her work and designated 2016-02-26 as "Vatsala Pathy Day" in honor of the contributions she made to the state.

Prior to her work for the State of Colorado, Vatsala Pathy founded and served as Managing Director of Rootstock Solutions LLC. Her work at Rootstock Solutions provided nonprofits, foundations, and governments to develop long-term business strategies to guide their healthcare efforts. She served as Senior Program Officer at The Colorado Health Foundation, where she was responsible for grant making and initiative development to support healthcare delivery for low-income populations. Vatsala was a Program Officer at the CDC Foundation, where she served as a steward and manager of several national and international public health projects. She has extensive experience on state health policy research and program implementation with the Office of Colorado Governor Roy Romer, the Georgia Health Policy Center, and Kaiser Foundation Health Plan of Colorado.

Vatsala Pathy is a recipient of the American Marshall Memorial Fellowship, and was selected to participate in the University of Colorado's Denver Community Leadership Forum. She is presently a trustee for the Bonfils Blood Center Operating Board, an advisory board member of Playworks, and trustee and chair of the heritage and compensation committees at St. Anne's Episcopal School. Vatsala received a Master of Public Affairs from the Lyndon B. Johnson School of Public Affairs, and a Master of Arts degree from the Institute of Latin American Studies at the University of Texas at Austin. She graduated cum laude with distinction with a Bachelor of Arts degree in political science and history with a Latin America concentration and a minor in North American Studies from Colorado College.

Board of Directors: Former Members

Eric Kessler

Eric Kessler, Founder, Principal, and Senior Managing Director, Arabella Advisors. Founder, Board Chair (2017), Board Secretary (through August 2019), New Venture Fund. President, Windward Fund. Co-Founder, Chef Action Network [see also: Katherine Miller, Treasurer & Vice-Chair, New Venture Fund]. Former National Field Director, League of Conservation Voters.

[Source]

Eric Kessler served as Chairman of the Board of Directors at the New Venture Fund until 2019-08. Eric Kessler founded and serves as senior managing director of Arabella Advisors, a social venture firm working to increase the effectiveness of philanthropy that works in conjunction with the New Venture Fund. Kessler helped manage conservation issues around the globe for the Bill Clinton administration. Kessler was Founding President of the NVF from 2006 to 2015

Other Key Staff

In 2019, NVF reported spending $59,279,859 in employee salaries and compensation (line 15 in Part I). The following are additional key staffers for the NVF in 2019 (Schedule J, IRS 2019 Form 990.

Pamela O. Foster

The New Venture Fund's highest-paid staffer in 2019 was Pamela O. Foster (total compensation: $399,048: 2019 Form 990 Schedule J, Part II, column B), Chief Operating Officer for the NVF social advocacy project Co-Impact, and a former Managing Director for the Rockefeller Foundation

Heather Joseph

Project Director; received $313,442 compensation in 2019.

Marc Kastner

Marc Kastner, an NVF Project Director (through 2019-12), and President of the Science Philanthropy Alliance (an NVF project), was compensated $338,553 in 2019.

Rakesh Ranani

Project Director. 2019 compensation: $332,156.

Valerie Conn

Valerie Conn is an NVF Project Director, and Executive Director of the Science Philanthropy Alliance; in 2019, she received compensation of $329,179.

Arkadi Gerney

Arkadi Gerney is an NVF Project Director, and head of the Hub Project (an NVF project) unlisted in NVF's 2019 Form 990. In 2019, he received compensation of $320,6753.

Financial Overview

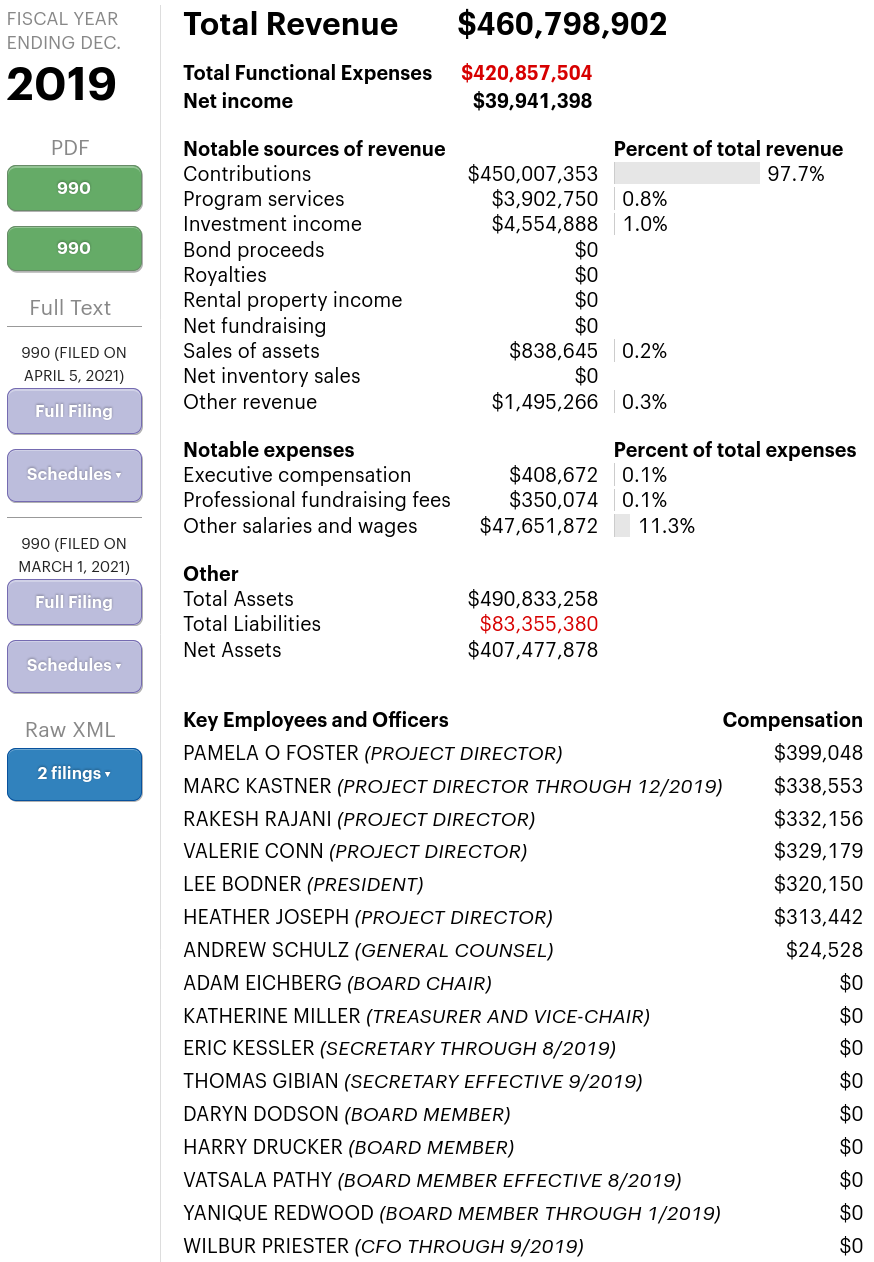

Source: IRS Form 990-PF tax filings for New Venture Fund for 2006-2019 are available from ProPublica.org's Nonprofit Explorer.

The New Venture Fund's application for recognition of tax-exempt status under the IRS was filed in January 2007 and is available here (pdf; 80pp) [source].

| New Venture Fund: Financials, from annual IRS Form 990's. |

| Source for IRS Form 990's: ProPublica.org Nonprofit Explorer. Net income = total revenue - total expenses. |

| Year | Total Revenue | Total Expenses | Net Income | Net Assets | Source |

| 2019 | $460,798,902 | $420,857,504 | $39,941,398 | $407,477,878 | 2019 |

| 2018 | $405,281,263 | $373,007,693 | $32,273,570 | $371,491,214 | 2018 |

| 2017 | $358,858,641 | $329,784,536 | $29,074,105 | $339,217,644 | 2017 |

| 2016 | $357,581,316 | $264,546,947 | $93,034,369 | $321,816,285 | 2016 |

| 2015 | $318,405,056 | $214,351,188 | $104,053,868 | $230,092,075 | 2015 |

| 2014 | $179,424,945 | $134,487,602 | $44,937,343 | $125,811,198 | 2014 |

| 2013 | $112,942,320 | $74,982,490 | $37,959,830 | $80,873,855 | 2013 |

| 2012 | $52,519,099 | $39,574,786 | $12,944,313 | $42,914,025 | 2012 |

| 2011 | $36,542,348 | $24,722,363 | $11,819,985 | $29,969,712 | 2011 |

| 2010 | $16,813,261 | $14,893,390 | $1,919,871 | $18,149,727 | 2010 |

| 2009 | $26,812,567 | $13,847,145 | $12,965,422 | $16,229,856 | 2009 |

| 2008 | $6,011,782 | $3,983,417 | $2,028,365 | $2,881,343 | 2008 |

| 2007 | $1,663,363 | $1,315,615 | $347,748 | $852,449 | 2007 |

| 2006 | $545,100 | $40,399 | $504,701 | $504,701 | 2006 |

| Totals: | $2,334,199,963 | $1,910,395,075 | |

New Venture Fund: donations and expenditures (2006-2018).

[Source]

New Venture Fund: donations and expenditures (2006-2018).

[Source]

New Venture Fund: sample form 990 summary (2019).

[Source]

New Venture Fund: sample form 990 summary (2019).

[Source]

Revenue

Donors to the New Venture Fund

Between 2007 and 2018, the New Venture Fund received approximately $842 million in grants from 501(c)(3) public charities and private foundations.

While the IRS does not require the New Venture Fund to report its donors, it is required to report its donation sums. The largest individual donations to the New Venture Fund in 2017, 2018 and 2019 are shown in the following table.

| Largest donors to the New Venture Fund. |

a Source: Schedule B (public disclosure copy),

2017 Form 990 | local copy |

b Source: Schedule B (public disclosure copy),

2018 Form 990 | local copy |

c Source: Schedule B (public disclosure copy),

2019 Form 990 | alt. source | local copy |

| 2017 a | 2018 b | 2019 c |

| $56,242,704 | $62,681,050 | $83,125,033 |

| $47,279,697 | $33,800,000 | $26,836,198 |

| $25,707,800 | $23,836,960 | $19,601,000 |

| $15,836,563 | $21,349,621 | $14,878,561 |

| $11,998,435 | $17,887,186 | $13,315,000 |

| $10,250,000 | $14,145,000 | $11,155,000 |

| $9,447,010 | $10,687,000 | $10,948,000 |

| --- | $8,662,625 | $10,479,396 |

| --- | $8,500,000 | $10,239,000 |

| --- | --- | $10,148,500 |

| --- | --- | $9,531,566 |

| --- | --- | $9,500,000 |

| --- | --- | $9,471,456 |

| --- | --- | $9,150,000 |

According to Schedule B in the public disclosure Form 990s, all of the largest contributions in the table above were from unnamed persons ("Type of contribution: Person").

| New Venture Fund: Major Known Donors a, b |

a Source: ProPublica.org Nonprofit Explorer. In most instances data were scraped from XML data via a bespoke (Persagen.com) BASH script.

Although not used for this table, Vipul Naik also provides a comprehensive analysis of donors to the New Venture Fund. |

b Note that these data rely both on known donors, and the availability of IRS Form 990 data. Accordingly, data in this table is for general understanding of donations to the New Venture Fund.

The data in this table do not represent a forensic audit: significant gaps may exist between what is shown, and datat actually exists (e.g., non-reported financial data). |

| c n.d.: no data available. |

| d Again, the "Overall" total should be loosely interpreted as a general indicator of the level of funding provided for the donors and years, shown above. |

| Year | Bill and Melinda Gates Foundation | Fidelity Investments Charitable Gift Fund | Gordon E and Betty I Moore Foundation | Ford Foundation | The Susan Thompson Buffett Foundation | William & Flora Hewlett Foundation | W.K. Kellogg Foundation | Rockefeller Foundation | Silicon Valley Community Foundation | David and Lucile Packard Foundation | Wyss Foundation | ... | Blue Meridian Partners Inc. |

| 2020 | n.d. c | 80,989,214 | n.d. | n.d. | 13,349,130 | n.d. | 2,925,000 | n.d. | n.d. | n.d. | n.d. | ... | 7,300,000 |

| 2019 | 42,835,747 | 73,326,502 | 20,138,384 | 16,640,000 | 11,741,124 | 18,998,000 | n.d. | 16,251,249 | 9,817,396 | 4,603,100 | n.d. | ... | 0 |

| 2018 | 82,315,200 | 65,264,890 | 31,100,362 | 15,822,550 | 9,853,185 | 9,600,000 | 1,388,633 | 21,124,996 | 6,838,000 | 4,921,705 | 8,500,000 | ... | 0 |

| 2017 | 69,366,833 | 39,919,827 | 29,697,859 | 15,709,450 | 17,071,535 | 12,961,500 | 2,964,604 | 4,175,300 | 2,970,000 | 3,522,500 | n.d. | ... | n.d. |

| 2016 | 74,723,583 | n.d. | 55,184,340 | 25,341,075 | 11,453,153 | 5,859,500 | 7,990,300 | 2,430,000 | 2,022,515 | 4,638,500 | n.d. | ... | n.d. |

| 2015 | 44,758,531 | n.d. | 10,512,604 | 22,252,020 | 27,482,733 | 10,248,000 | 3,070,204 | 453,185 | 5,722,000 | 3,380,000 | 4,052,800 | ... | n.d. |

| 2014 | 40,571,306 | n.d. | 7,979,061 | 14,375,000 | 2,439,455 | 8,290,000 | 19,518,308 | 151,363 | 5,240,000 | 2,893,101 | 6,352,800 | ... | n.d. |

| 2013 | 19,445,969 | n.d. | 4,756,188 | 8,700,000 | 1,800,727 | 8,042,600 | 2,686,684 | 105,000 | 32,500 | 1,265,400 | 1,050,000 | ... | n.d. |

| 2012 | 13,986,572 | n.d. | 947,550 | 1,802,000 | 600,000 | 6,365,000 | 4,042,843 | 75,000 | 0 | 755,000 | 605,000 | ... | n.d. |

| 2011 | 8,914,402 | n.d. | 0 | 150,000 | 0 | 7,520,000 | 1,079,910 | 150,000 | 532,500 | 889,000 | 1,775000 | ... | n.d. |

| 2010 | 3,668,779 | n.d. | n.d. | 0 | n.d. | 1,440,000 | 595,207 | 0 | 40,500 | 3,277,500 | 225,000 | ... | n.d. |

| Total | 400,586,922 | 259,500,433 | 160,316,348 | 120,792,095 | 95,791,042 | 89,324,600 | 46,261,693 | 44,916,093 | 33,215,411 | 30,145,806 | 20,785,600 | ... | 7,300,000 |

| Overall d | $1,308,936,043 |

Expenditures

Projects and Issue Areas

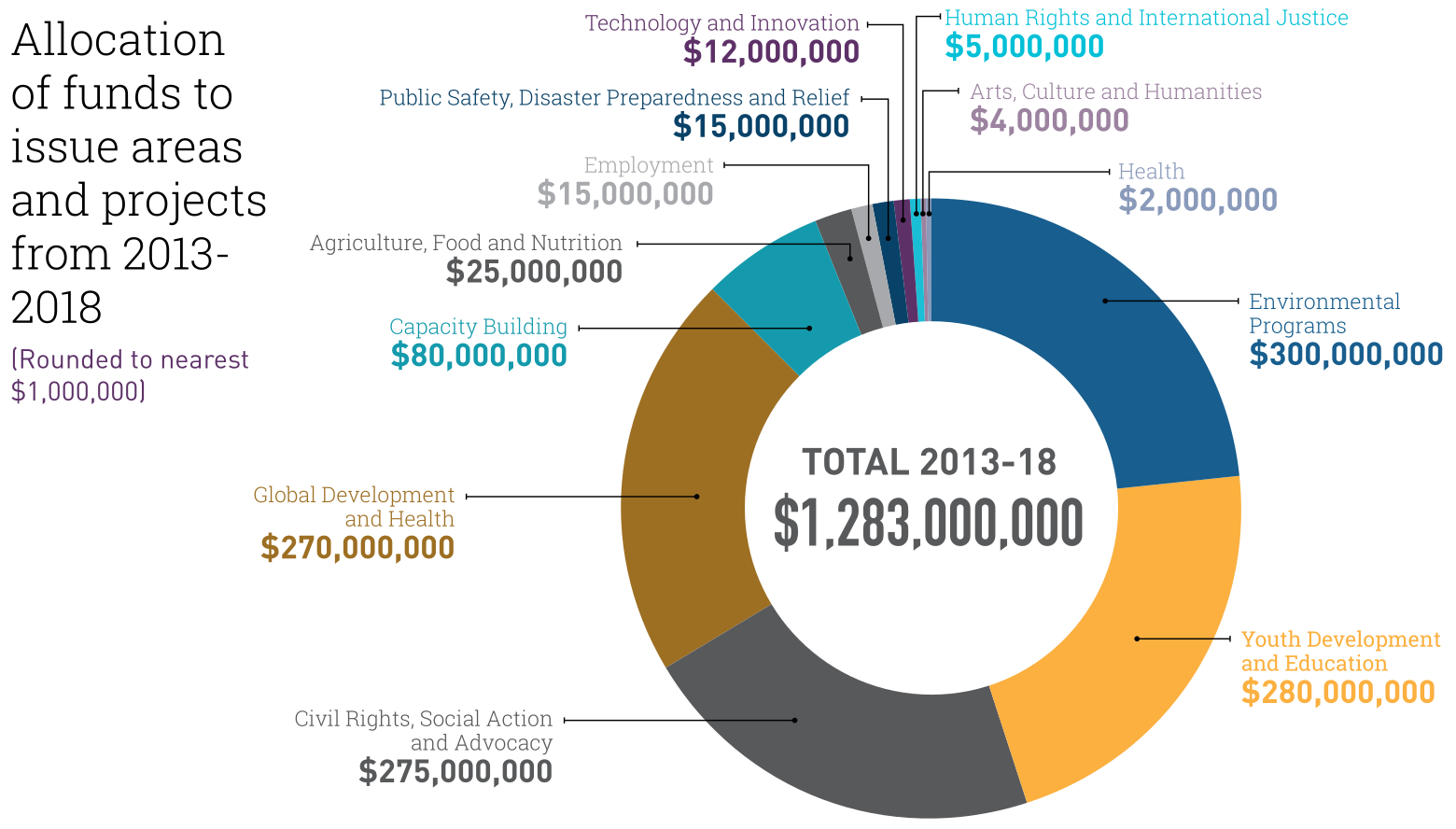

New Venture Fund (NVF) provides an overview of their operations in their 2019-12 impact report, New Venture Fund: Using Philanthropy to Shape a More Just, Equitable and Sustainable Future | local copy. That report summarized key project areas funded by NVF, including (cumulative funding amounts, 2013-2018):

| Overview of Areas Funded by the New Venture Fund |

| Cumulative funding (2013-2018) | Program Area |

| $300,000,000 | Environment |

| $280,000,000 | Youth development & education |

| $275,000,000 | Civil rights, social action, & advocacy |

| $270,000,000 | Global development & health |

| $80,000,000 | Capacity building |

| $25,000,000 | Agriculture, food & nutrition |

| $53,000,000 | Other (public safety; technology; human rights; arts; health) |

Allocation of funds to issue areas and projects from 2013-2018.

[Source]

Allocation of funds to issue areas and projects from 2013-2018.

[Source]

Allocation of funds across regions from 2013-2018.

[Source]

Allocation of funds across regions from 2013-2018.

[Source]

Education

New Venture Fund gave about $4 million [WatchDog.org, 2015-11-16, local copy] to a failed Mississippi initiative in 2015 that would have given state judges power over school issues, including increased education spending.

In a report over the National Education Association's $138 million in spending in the 2016 fiscal year, Dropout Nation, an education reform website, pointed out the national teachers union gave $62,657 to New Venture Fund and $550,000 to Sixteen Thirty Fund, an endowment developed by Arabella Advisors. Eric Kessler, the President and Board Chairman of New Venture Fund, also founded Arabella Advisors.

Additional Reading

[ReadSludge.com, 2021-09-14] Gates Foundation Was Major Donor to Pro-Biden 'Dark Money' Network. The parent organization of a Democratic Party "dark money" behemoth received nearly $70 million from the Bill and Melinda Gates Foundation in 2020 as it financed super PACs boosting Joe Biden's presidential campaign. | Reblogged [2021-09-15] Defense Giants Spend Big on Lobbying and Elections to Boost Post-9/11 Profits.

The Bill and Melinda Gates Foundation gave nearly $70 million last year to a major liberal charity that acts as the "parent" organization of one of the largest pro-Democrat dark money groups, a recent update to the group's online grant database reveals. It was the largest one-year commitment the Bill and Melinda Gates Foundation has made since 2014, and its second largest ever.

The donations were given to Arabella Advisors' New Venture Fund (NVF), a major player in the political nonprofit sphere that is the payroll reporting agent for Sixteen Thirty Fund, a dark money group that funneled tens of millions to super PACs during that 2020 election cycle that backed Democratic Party candidates including President Joe Biden. The most recent tax returns available (2019) show that New Venture Fund, which raised $450 million from anonymous sources that year, transferred $33 million to Sixteen Thirty - the largest single donation given by the former and received by the latter.

[ ... snip ... ]

[Jaeger.Substack.com, 2021-08-18] Liberal Dark Money Network Received $80M+ Anonymously Through Fidelity Charitable. The Nation's Largest Donor-Advised Fund Was A Prime Facilitator For Donations To Dark Money Groups, Filings Show.

Recently released tax forms first reported by PolitiFi show that the nation's largest donor-advised fund, Fidelity Charitable, facilitated over $80 million in anonymous donations to dark-money juggernaut, New Venture Fund - who acts as the parent group to another major (and politically active) dark money group, Sixteen Thirty Fund. The donation(s) occurred between the dates of 2019-07-01 to 2020-06-30. The donations bring New Venture Fund's total haul through Fidelity Charitable at over $153 million since 2018-07. ...

[Medium.com/RobletoFire, 2021-01-17] Filings Show Major Liberal Dark Money Group Funded By Fidelity Charitable, Gates Foundation.

[New Venture Fund, 2019-12] New Venture Fund: Using Philanthropy to Shape a More Just, Equitable and Sustainable Future. | local copy

(report, pdf)

Return to Persagen.com