Wellspring Philanthropic Fund

| URL |

https://Persagen.com/docs/wellspring_philanthropic_fund.html |

| Sources |

Persagen.com | InfluenceWatch.org | other sources (cited in situ) |

| Source URL |

https://www.influencewatch.org/non-profit/wellspring-philanthropic-fund/ |

| Date published |

2021-08-30 |

| Curation date |

2021-08-30 |

| Curator |

Dr. Victoria A. Stuart, Ph.D. |

| Modified |

|

| Editorial practice |

Refer here | Dates: yyyy-mm-dd |

| Summary |

The Wellspring Philanthropic Fund, formerly known as the Matan B'Seter Foundation, was created in 2001 as part of an elaborate and secretive network of grantmaking organizations funded by three hedge fund billionaires: Andrew Jay Shechtel, David Gelbaum, and C. Frederick "Fred/Freddy" Taylor. For most of 2001 through most of 2017 Wellspring/Matan B'Seter gave grants totaling nearly $900 million. The final recipients for $795 million (88.3 percent) of this funding are not known; through 2015, Wellspring gave nearly all annual grants to two of the nation's largest donor-advised fund providers that are not required to disclose how individual donors direct them to give the money away. |

| Key points |

|

| Related |

|

| Keywords |

Show

- billionaires

- disproportionate influence

- extreme wealth

- hedge fund billionaires

- philanthropy

- advocacy

- anonymous donors

- 501(c)(3) organization

- charities

- dark money

- donor-advised funds

- grantmaking organizations

- lobbying

- nonprofit organizations

- pass-through funder

- secrecy

- secretive advocacy groups

- capitalism

- derivatives

- hedge funds

- hedging

- investment firm

- investment management company

- junk bonds

- market neutral derivatives hedging

- profiteering

- racketeering

- stock market

- stock prices

- tax fraud

- trading platforms

- algorithmic profiteering

- computational trading platforms

- mathematical trading platforms

- probability

- quantitative trading

- securities markets

- statistical arbitrage

- statistics

- center-left politics

- civic engagement

- economic justice

- electioneering

- election reform

- left-of-center

- left-of-center advocacy

- left-of-center politics

- left-wing

- left-wing politics

- politics

- voter engagement

- voter registration

- human rights

- LGBT

- poverty

- social justice

- women's health

|

| Named entities |

Show

- Education:

- American University

- Barnard College

- Harvard University

- Haverford College (private liberal arts college, Haverford, Pennsylvania; alumnus: C. Frederick Taylor)

- Princeton University

- Princeton School of Public and International Affairs (Princeton University; formerly: Woodrow Wilson School of Public and International Affairs)

- News media:

- Algemeiner Journal

- Bloomberg Businessweek

- InfluenceWatch.org

- Philanthropy News Digest (a daily news service of the Foundation Center, which in 2019 merged with GuideStar to form a new organization, Candid)

- Princeton Info (PrincetonInfo.com, now CommunityNews.org)

- Law firms:

- Berger Montague

- Dechert LLP (formerly: Dechert, Price & Rhoads)

- Lowenstein Sandler LLP (Wellspring Philanthropic Fund articles of incorporation; representative, Wellspring funders)

- Sandals & Langer LLP (formerly: Sandals, Langer & Taylor LLP)

- Advocacy:

- Advocates for Youth

- Alliance for Justice

- American Constitution Society for Law and Policy

- Analyst Institute (for-profit organization; assists left-of-center organizations)

- Astraea Lesbian Foundation for Justice

- Atlantic Philanthropies, The (health, social, politically left-leaning public policy causes in Australia, Bermuda, Ireland, South Africa, USA, Vietnam)

- Attic Youth Center (Philadelphia, Pennsylvania LGBT youth center)

- Audubon Society

- Ballot Initiative Strategy Center

- Bill and Melinda Gates Foundation

- Borealis Philanthropy

- Bus Federation Civic Fund (i.e. Alliance for Youth Organizing)

- Campaign Legal Center

- Carnegie Corporation of New York ("Carnegie Corporation")

- Center for American Progress

- Center for Community Change

- Center for Constitutional Rights

- Center for Health and Gender Equity (CHANGE)

- Center for Law and Social Policy (CLASP)

- Center for Popular Democracy

- Center for Public Integrity

- CHDI Foundation (non-profit biomedical foundation studying Huntington's disease)

- Chicken & Egg Pictures

- Citizens for Responsibility and Ethics in Washington (CREW)

- Coalition on Human Needs

- Colorado Civic Engagement Roundtable

- Colorofchange.org Education Fund

- Commonwealth Institute for Fiscal Analysis

- Community Catalyst

- Democracy Alliance (seeks to increase voter engagement among people of color, women, and young people)

- Demos (liberal think tank; elections reform)

- ELMA Foundation (ELMA Philanthropies)

- Equality Advocates Pennsylvania (formerly: Center for Lesbian and Gay Civil Rights)

- EngenderHealth (international women's health organization)

- Equality Advocates Pennsylvania (Equality Pennsylvania)

- Equality Pennsylvania (formerly: Center for Lesbian & Gay Civil Rights Equality Advocates Pennsylvania)

- Every Child Matters Education Fund

- Faith In Action

- Forward Together

- Franciscan Sisters of Mary and the Wallace Global Fund (project of Arabella Advisors)

- Funders Committee for Civic Participation (FCCP)

- Global Philanthropy Project (global philanthropic LGBT support)

- Government Accountability Project

- Groundswell Fund

- Guttmacher Institute (reproductive health; birth control)

- The Heartland Fund (project of Windward Fund, which is managed by Arabella Advisors)

- Hopewell Fund (affiliated with Arabella Advisors)

- Human Rights Watch

- Humentum (formed, 2017, via merger of InsideNGO, LINGOs, and Mango)

- LGBTQ Victory Institute (LGBTQ Victory Fund, a 527 political action committee

- MomsRising Education Fund

- Ms. Foundation for Women

- National Domestic Workers Alliance (NDWA)

- National Latina Institute for Reproductive Justice (formerly: National Latina Institute for Reproductive Health)

- National Women's Law Center

- Peripheral Vision International (international development organization; focus: Sub-Saharan Africa)

- Peace and Security Funders Group

- People's Action Institute

- Planned Parenthood Federation of America Inc. ("Planned Parenthood")

- Planned Parenthood Foundation

- 501(c)(3) foundation that pools contributions from individuals, families and foundations." href="https://en.wikipedia.org/wiki/Ploughshares_Fund">Ploughshares Fund

- Political Research Associates

- Population Action International

- Population Council

- Public Citizen Foundation

- Project On Government Oversight

- Protect Democracy Project

- Public Employees for Environmental Responsibility

- Public Policy Institute of California

- Research Collaborative Fund (under: Public Policy Institute of California; project of: Arabella Advisors' New Venture Fund)

- Sierra Club

- Service Employees International Union

- State Voices

- Survivor Corps [formerly: Landmine Survivors Network]

- The Edna McConnell Clark Foundation (opportunities for low-income youth in USA)

- Windward Fund (managed by Arabella Advisors; project: The Heartland Fund)

- Philanthropy Advancing Women's Human Rights (founding member: Wellspring Philanthropic Fund)

- World Bank

- World Neighbors (Oklahoma City, Oklahoma)

- Philanthropy (including secretive advocacy groups):

- Hedge fund profiteering - individuals:

- Edward Oakley "Ed" Thorp (mathematician; hedge fund algorithms, investor; founder: Princeton Newport Partners)

- Jay Regan (investor, Princeton Newport Partners)

- Michael Milken (financier; senior executive, Drexel Burnham Lambert; philanthropist; junk bonds; convicted felon)

- Financial markets - general:

- Drexel Burnham Lambert (financier Michael Milken; bankrupt American multinational investment bank; junk bonds )

- Financial crisis of 2007-2008

- Hedge fund profiteering - companies;

- Convertible Hedge Associates (Edwin Thorpe; Jay Regan; predecessor to Princeton Newport Partners)

- Princeton Newport Partners (1969 to 1989; founder: Edward Oakley Thorp; member: Andrew Jay Shechtel)

- TGS Management (Andrew Jay Shechtel)

- TGS Management Company LLC

- Wellspring Philanthropic Fund - funders:

- BLTN Holdings, LLC (c/o Lowenstein Sandler LLP)

- MBS Funding

- Rubik Enterprises, LLC (c/o Lowenstein Sandler LLP)

- Shackleton Company

- Twenty-One Holdings, LLC (c/o Lowenstein Sandler LLP)

- Wellspring Philanthropic Fund | Wellspring Advisors - key individuals:

- Adam Barber (Governor, Wellspring Advisors)

- Caroline Brazill (Program Assistant, Atrocities Prevention & Response Program, Wellspring Advisors, LLC; American University alumnus)

- Raymond Eng (Governor, Wellspring Advisors; possibly: teacher-advisor, High Technology High School, New Jersey)

- David Gelbaum (cofounder; hedge fund billionaire)

- Michael Gibbons (Program Director, Wellspring; Scholar in Residence, School of Education, American University)

- Andrew Jay Shechtel (cofounder; hedge fund billionaire; investment banker; MBA, Harvard University; Princeton Newport Partners; TGS Management)

- C. Frederick "Fred/Freddy" Taylor (cofounder; hedge fund billionaire; alumnus, Haverford College)

- John Reid Taylor (cofounder; President, Wellspring Philanthropic Fund; Managing Partner, Wellspring Advisors; Governor, Wellspring Advisors)

- William Myles Taylor (cofounder; Vice President; Governor, Wellspring Advisors)

- Jeanne Haws (Chief Operating Officer; formerly at: Princeton School of Public and International Affairs)

- Jackie Williams Kaye (Chief Learning & Evaluation Officer)

- Wellspring Philanthropic Fund - Trustees:

- John L. Berger (Trustee, Wellspring Philanthropic Fund)

- Allen B. Levithan (Rutgers Law School; Lowenstein Sandler LLP; Trustee, Wellspring Philanthropic Fund; deceased 2019)

- George J. Mazin (retired partner, Dechert LLP; Trustee, Wellspring Philanthropic Fund)

- Kenneth J. Slutsky (Partner, Lowenstein Sandler LLP; Trustee, Wellspring Philanthropic Fund; President, Treasurer: CHDI Foundation)

- Wellspring Philanthropic Fund - key staff:

- Lesley Carson (Director, International Human Rights Program)

- Rebecca Fox (Senior Program Officer, Sexual Orientation and Gender Identity Program)

- Laura Katzive (Senior Program Officer)

- Joyce Malombe (Senior Program Officer, Wellspring's International Children's Education program)

- Cassandra McKee (Program Officer)

- Jodeen Olguin-Tayler (Program Officer)

- Ilona Prucha (Program Officer)

- Wellspring Philanthropic Fund - organizations & programs:

- Atrocities Prevention and Response Program (Wellspring Advisors)

- International Children's Education program (Wellspring Philanthropic Fund )

- Wellspring Advisors LLC

- Wellspring Philanthropic Fund (formerly Matan B'Seter Foundation)

- Other mentions - general:

- Other mentions - groups:

- DC Leaks (hacker organization)

- Jewish Community

- Other mentions - individuals:

- Deepak Bhargava (Executive Director, 2002-2018, Center for Community Change; 2019-present Distinguished Lecturer of Urban Studies, CUNY School of Labor and Urban Studies)

- Ted Cruz (R-TX; United States Senator)

- Mary Kay Henry (current President, Service Employees International Union)

- David Kligman (family practitioner, Brooklyn, New York City; investigator, Chief Medical Examiner's Office of NYC; medical inspector, NYC Board of Education; father of Raquel Kligman, wife of Andrew Jay Shechtel)

- Raquel Kligman (wife of Andrew Jay Shechtel; Vice President, Lory Roston Associates, a public- relations firm in New York; graduate of Barnard College)

- Barack Obama (former President of the United States)

- Pierre Omidyar (French-American billionaire; technology entrepreneur; philanthropist; Omidyar Network; Democracy Fund)

- Nelson Shechtel (Bowie, MD; lawyer, Securities and Exchange Commission, Washington DC; father of Andrew Jay Shechtel)

- Rhoda Shechtel (environmental analyst with the Department of Energy; wife of Nelson Shechtel; mother of Andrew Shechtel)

- George Soros (billionaire philanthropist; Open Society Foundations)

- Andrew L. "Andy" Stern (President Emeritus, Service Employees International Union; President, 1996-2010)

- Politics - United States:

- 2012 United States elections

- 2018 United States elections

- 2020 United States Census

- Democratic Party

- Republican Party

- Internal Revenue Service (IRS)

- Racketeer Influenced and Corrupt Organizations (RICO) Act

- Geographical - United States:

- Brooklyn, New York City

- Bowie, Maryland

- Haverford, Pennsylvania

- Long Beach, California

- Manhattan, New York City

- New York City, New York

- Oklahoma City, Oklahoma

- Philadelphia, Pennsylvania

- Princeton, New Jersey

- Roseland, New Jersey

- California

- District of Columbia

- Maryland

- New Jersey

- New York

- Oklahoma

- Pennsylvania

- United States

- Geographical - global:

- Africa

- Australia

- Bermuda

- Ireland

- South Africa

- Sub-Saharan Africa

- Vietnam

|

| Ontologies |

Show

- Science - Social sciences - Economics - Economic systems - Capitalism - Advocacy - Lobbying - Advocacy groups - Secretive advocacy groups - United States

- Society - Charitable giving & Practices - Politics - Countries - United States - Organizations - Nonprofit organizations - 501(c)(3) organizations - Ford Foundation

- Society - Charitable giving & Practices - Politics - Organizations - Nonprofit Organizations - Dark money

- Society - Charitable giving & Practices - Politics - Organizations - Nonprofit Organizations - Dark money - Countries - United States - Donor-advised funds - Arabella Advisors

- Society - Charitable giving & Practices - Politics - Organizations - Nonprofit Organizations - Dark money - Countries - United States - Donor-advised funds - NEO Philanthropy

- Society - Charitable giving & Practices - Politics - Organizations - Nonprofit Organizations - Dark money - Countries - United States - Donor-advised funds - Arabella Advisors - New Venture Fund

- Society - Charitable giving & Practices - Politics - Organizations - Nonprofit Organizations - Dark money - Countries - United States - Donor-advised funds - Open Society Foundations

- Society - Charitable giving & Practices - Politics - Organizations - Nonprofit Organizations - Dark money - Countries - United States - Donor-advised funds - Wellspring Philanthropic Fund

- Society - Charitable giving & Practices - Politics - Organizations - Nonprofit Organizations - Dark money - Countries - United States - Donor-advised funds - Wellspring Philanthropic Fund - Wellspring Advisors LLC

- Society - Issues - Inequality - Economic inequality - Wealth inequality - Extreme wealth - Billionaires

|

Wellspring Philanthropic Fund

|

| Name |

Wellspring Philanthropic Fund |

| Former name |

Matan B'Seter Foundation |

| Founded |

Certificate of incorporation

(1999-11-24, New Jersey | local copy) |

| Operational |

2001 |

| Cofounders |

|

| President |

John Reid Taylor | local copy, 2021-08-31 | Managing Partner, Wellspring Advisors |

| Vice-President |

William Myles Taylor |

| Executives |

|

| Initiative of |

Wellspring Philanthropies |

| Managed by |

Wellspring Advisors |

| Type |

501(c)(3) nonprofit organization |

| EIN (Tax ID) |

22-3692921 |

| Location |

New York, New York, USA |

| Key staff |

- Joyce Malombe, Senior Program Officer, International Children's Education

- Rebecca Fox, Senior Program Officer, Sexual Orientation and Gender Identity Program

- Lesley Carson, Director, International Human Rights Program; board member, SAGE Fund

- Cassandra McKee, Program Officer

- Laura Katzive, Senior Program Officer

- Ilona Prucha, Program Officer

- Jodeen Olguin-Tayler, Program Officer | local copy, 2021-08-31

|

| Revenue |

- 2019: $305,752,749

- 2018: $289,224,841

- 2017: $253,505,642

- 2016: $216,332,067

- 2015: $193,040,139

|

| Expenses |

- 2019: $281,520,924

- 2018: $257,887,586

- 2017: $205,480,974

- 2016: $217,150,420

- 2015: $203,678,000

|

| Assets |

- 2019: $105,641,216

- 2018: $79,227,350

- 2017: $47,890,095

- 2016: $5,505,562

- 2015: $6,323,915

|

| Description |

"The Wellspring Philanthropic Fund opened its doors in 2001 with a mission to effectively and strategically improve the realization of human rights and social and economic justice for all people." |

| Known for |

- Secrecy (dark money)

- Large-scale funding: 100s of million dollars

|

| Associations |

|

| Affiliations |

Wellspring Advisors (for-profit organization) |

| Website |

WPFund.org/ |

Historical Background

Edward Oakley "Ed" Thorp

Sources for this subsection: Edward O. Thorp (Wikipedia) | Princeton Newport Partners (Wikipedia) | Wellspring Philanthropic Fund (InfluenceWatch.org)

Edward Oakley "Ed" Thorp (born August 14, 1932; personal webpage) is an American mathematics professor who developed and applied effective hedge fund techniques in the financial markets. Since the late 1960s, Edward Thorp has used his knowledge of probability and statistics in the stock market by discovering and exploiting a number of pricing anomalies in the securities markets and has made a significant fortune.

Princeton Newport Partners

Additional source: Wikipedia, 2021-09-01:

Convertible Hedge Associates was an early alternative investment management company founded by Edward O. Thorp and a partner, Jay Regan, in November 1969. Based in Long Beach, California, Convertible Hedge Associates was said by Thorp to have been the first market-neutral hedge fund. In 1974 it was renamed as Andrew Shechtel: Princeton Newport Partners.

Founded in 1974, Princeton Newport Partners was stated by its founder - mathematics professor Edward O. Thorp - to be the world's first market neutral hedge fund. Princeton Newport Partners was a pioneer in quantitative trading techniques, profiting from mispricings in derivatives, and later statistical arbitrage, which involved trading a large number of stocks for short-term returns. Princeton Newport Partners achieved an annualized rate of return of 20 percent after fees for over two decades, without a single down quarter, until becoming embroiled in the junk bond schemes of Michael Milken's circle at Drexel Burnham Lambert. Thorp and other principals at Princeton Newport Partners were eventually cleared of wrongdoing, but the financial burdens imposed by the ensuing Racketeer Influenced and Corrupt Organizations (RICO) Act investigation forced Princeton Newport Partners to liquidate. Edward Thorp's circle of associates later regrouped as TGS Management, with focus on statistical arbitrage.

Edward Thorp's first hedge fund was Princeton Newport Partners, which operated from 1969 to 1989, and was based on market neutral derivatives hedging. Princeton Newport Partners, one of the first investment firms to use mathematical formulas to price stocks and derivatives.

Princeton Newport Partners was liquidated in 1989, following an investigation under the Racketeer Influenced and Corrupt Organizations (RICO) Act and the indictment of its five partners on racketeering and tax-fraud charges. An appellate court later overturned the executives' convictions; however, the financial burdens imposed by the RICO investigation forced the liquidation of Princeton Newport Partners. Edward Thorp's circle of associates later regrouped as the TGS Management Company, with focus on statistical arbitrage.

TGS Management Company, LLC

Source for this subsection: InfluenceWatch.org.

In June 2017, a report in the school-run business paper Princeton Info identified TGS Management Company, LLC [company website] (TGS) as the "secretive successor" to the failed firm Princeton Newport Partners.

Under RICO law federal prosecutors had the power to seize the assets of Princeton Newport Partners. So after the raid the firm was dissolved and several of the traders who had not been charged created their own hedge firm, which to this day operates in the former Princeton Newport Partners space at 33 Witherspoon Street [Princeton, New Jersey], with a computer operation based in California.

That firm is called TGS, named after partners C. Frederick Taylor, a Haverford College alumnus; David Gelbaum, a mathematics major from the University of California-Irvine and one of Ed Thorp's earliest hires; and Andrew Jay Shechtel, who had been a trader in the Princeton, New Jersey office when the federal raid occurred.

"TGS" is reportedly an acronym named for Wellspring cofounders C. Frederick Taylor, David Gelbaum, and Andrew Jay Shechtel. [None of the three men were charged with crimes following federal RICO raids on Princeton Newport Partners.] C. Frederick Taylor is listed as a cofounder of TGS.

TGS Management: A "Byzantine" Network

Source for this subsection: InfluenceWatch.org.

Sometime in or around 2000 Wellspring's founders created what Philanthropy News Digest [a daily news service of the Foundation Center, which in 2019 merged with GuideStar to form a new organization, Candid] characterized [local copy] as a "byzantine" (i.e., labyrinthine) network involving "layers of company subsidiaries" in various states which allowed them to "disguise" their donations and "avoid almost all public scrutiny of their activities." The network [TGS Management] and its donors remained mostly hidden from public view until exposed by a May 2014 Bloomberg Businessweek report: "The $13 Billion Mystery Angels" [local copy].

David Gelbaum retired from TGS Management Company in or around 2014, leaving Andrew Jay Shechtel and C. Frederick Taylor to manage it. David Gelbaum and his wife reportedly ceased their philanthropic giving in 2013. According to Gelbaum's lawyer - as reported by the Algemeiner Journal - David Gelbaum "lost more than he thought he could possibly lose" during the financial crisis of 2007-2008.

Wellspring Philanthropic Fund

Background

Source: InfluenceWatch.org, 2021-08-30 | local copy, 2021-08-31.

The Wellspring Philanthropic Fund, formerly known as the Matan B'Seter Foundation, was created in 2001 as part of an elaborate and secretive network of grantmaking organizations funded by three hedge fund billionaires: Andrew Jay Shechtel, David Gelbaum, and C. Frederick Taylor. Philanthropy News Digest described their intent as to "disguise" donations and "avoid almost all public scrutiny." "Matan B'Seter" is a Hebrew phrase meaning "anonymous gift."

According to its articles of incorporation [local copy], the Wellspring Philanthropic Fund was incorporated in 1999 in Roseland, New Jersey as the "Matan B'Seter Foundation," a 501(c)(3) private foundation (though the group considers its formation year 2001). In 2016, the group adopted its current name, the Wellspring Philanthropic Fund.

From the start, the Wellspring Philanthropic Fund was one arm of an elaborate and secretive network of corporations and charities funded by three hedge fund billionaires: Andrew Jay Shechtel, David Gelbaum, and C. Frederick Taylor. "Matan B'Seter" is a Hebrew phrase meaning "anonymous gift," according to the Algemeiner Journal, a journal serving the Jewish community. The Algemeiner Journal noted at least two of the three billionaires (Gelbaum and Shechtel) are Jewish, and that other subsidiaries within their network (such as one named "Shekel Funding") bore "Hebrew or Israeli-related names."

The three men were partners in the hedge fund TGS Management Company, LLC; C. Frederick Taylor is specifically listed as the firm's co-founder beginning in 1989. Sometime in or around 2000 they created what Philanthropy News Digest characterized as a "byzantine" network involving "layers of company subsidiaries" in various states which allowed them to "disguise" their donations and "avoid almost all public scrutiny of their activities."

The individual hedge fund billionaire most closely affiliated with the Wellspring Philanthropic Fund / Matan B'Seter arm of the network is C. Frederick Taylor, a committed donor to Democratic Party politicians and causes.

The Wellspring Philanthropic Fund and its donors remained mostly hidden from public view, until exposed by a May 2014 Bloomberg Businessweek report: "The $13 Billion Mystery Angels" [local copy]. At the time of this report the total assets of the philanthropic entities within the network (of which Matan B'Seter was one arm) was valued at $9.7 billion. If the total network had been considered as a single foundation, it would have ranked as the fourth-largest, behind only the Bill and Melinda Gates Foundation, the Ford Foundation, and the Getty Foundation. A lawyer with expertise in the tax-exempt sector characterized the secretive nature of the funding network as in keeping with the letter of the law for charitable foundations, though perhaps not the spirit, saying "most of us who practice in the tax-exempt arena would regard setting up a private foundation as a full-disclosure vehicle."

According to Federal Election Commission records, Andrew Jay Shechtel has been a frequent donor to numerous Republican Party congressional candidates, such as a $2,500 donation toward the reelection of U.S. Senator Ted Cruz (R-TX) during the 2018 election cycle. The most active reported funding role by him in the philanthropic network was as a major supporter of medical research aimed at a cure for Huntington's disease.

Federal Election Commission records show that a "Fred Taylor" living in California and reporting the investment firm "TGS Management" as his employer is a reliable donor to Democratic Party candidates, giving $55,000 to the re-election of President Barack Obama in 2012. Along with two of his brothers [John Reid Taylor; Myles Taylor], https://en.wikipedia.org/wiki/Barack_Obama created Wellspring Advisors, which Philanthropy News Digest characterized as a "consulting firm for anonymous donors." Sometime after 2014 the name of the Matan B'Seter Foundation was changed to the Wellspring Philanthropic Fund. And according to an announcement purportedly from Wellspring Philanthropic Fund (preserved by the website of the Global Philanthropy Project), Wellspring Advisors "shifted to become Wellspring Philanthropic Fund" on January 1, 2018.

For most of 2001 through most of 2017 the Wellspring Philanthropic Fund / Matan B'Seter Foundation gave grants totaling nearly $900 million. The final recipients for $795 million (88.3 percent) of this funding are not known; through 2015, Wellspring gave nearly all annual grants to two of the nation's largest donor-advised fund providers that are not required to disclose how individual donors direct them to give the money away.

In 2017, the Wellspring Philanthropic Fund began selectively donating directly to some organizations, allowing a window into its ideological priorities, and $28.5 million (11.6 percent of the 2017 total) was given to 56 left-of-center advocacy organizations. At least $4 million of these grants referenced voter engagement and outreach projects at left-of-center organizations such as NEO Philanthropy and New Venture Fund [Arabella Advisors]. "DC Leaks," a group suspected by the United States Government of being a front for Russian intelligence,released a memo hacked from the George Soros-backed Open Society Foundations in 2016 that portrays the Open Society Foundations as one participant in a $65.4 million left-of-center voter engagement effort that allegedly occurred prior to the 2012 election, with Wellspring as a $10 million contributor.

Criticism

In 2014, Wellspring Philanthropic Fund founders Andrew Jay Shechtel, John Reid Taylor, and C. Frederick Taylor were criticized by a writer for Nonprofit Quarterly for "promoting enhanced charitable deductions" for major donors which otherwise would have been collected as tax dollars by the government. Nonprofit Quarterly also explained that that the founders have generally promoted greater deductions for donors to specific causes, such as "programs targeting rare diseases."

Founders: Overview

Source: InfluenceWatch.org, 2021-08-31.

Andrew Jay Shechtel, David Gelbaum, and C. Frederick Taylor are the founders of Wellspring Philanthropic Fund (then Matan B'Seter Foundation). As of July 2019 the website of the Wellspring Philanthropic Fund lists "John Taylor" as the group's president, "Myles Taylor" as its vice president, and identifies them as brothers who co-founded the fund in 2000. No mention was made of C. Frederick Taylor on the website's pages.

According to its latest filings with the District of Columbia, Wellspring Philanthropic Fund is governed by a board consisting of president John Taylor, vice president William Myles Taylor, Raymond Eng, and Adam Barber [local copy, 2021-09-01].

The three Taylors are listed as brothers in multiple online reports. Myles Taylor (full name William Myles Taylor) is called a "consultant" to Wellspring Advisors. John Reid Taylor is listed as a "Pennsylvania lawyer." C. Frederick Taylor (often called Frederick Taylor, or Fred Taylor) is identified as a hedge fund investor. C. Frederick Taylor is also an alumnus of Haverford College, in Pennsylvania.

Key Leaders

David Gelbaum, Cofounder

Source: Wikipedia, 2021-08-31.

It was probably while teaching at the University of California, Irvine in the early 1970s that Edward Oakley Thorp met the first of Wellspring's three future founders, David Gelbaum (above). After graduating, Gelbaum joined Thorp's new hedge fund, along with two more future Wellspring founders: Andrew Jay Shechtel, and C. Frederick Taylor. [source]

David Gelbaum (c. 1950 - September 2018) was an American businessman and primarily green technology investor and environmental philanthropist.

Beginning in 2002, David Gelbaum invested up to $500 million in clean-tech companies through his Quercus Trust, with a portfolio of businesses involved in nearly every aspect of the emerging green economy, be it renewable energy, smart electric grids, sustainable agriculture, electric cars or biological remediation of oil spills. David Gelbaum was CEO and Chairman of the Board of Entech Solar, a company he co-founded with Mark O'Neill.

David Gelbaum: Career

David Gelbaum was born and raised in Minneapolis, Minnesota, the second of four sons. David Gelbaum studied at University of California, Berkeley and Humboldt State University in Northern California before graduating with a B.A. in mathematics from University of California, Irvine. After graduating, David Gelbaum worked for a math professor, Edward O. Thorp, whose theories led to the establishment of what became Princeton Newport Partners, one of the first investment firms to use mathematical formulas to price stocks and derivatives. Princeton Newport Partners collapsed in 1989, following the indictment of five executives in connection with a scheme to create illegal tax losses. Mr. Thorp and Mr. Gelbaum were not implicated, and an appellate court later overturned the other executives' convictions.

From 1972 to 1989, David Gelbaum worked at Princeton Newport Partners, performing quantitative modeling for stock price returns and derivative securities. David Gelbaum moved to TGS Management with a similar capacity until 2002.

David Gelbaum is an alumnus of the University of California, Irvine who was reportedly hired by hedge fund manager and blackjack researcher Edward O. Thorpe, author of the book Beat the Dealer, which proved that a casino's house advantage could be overcome by counting cards.

David Gelbaum investment focus was on the environmental technology and renewable energy industries having served on various public company boards in these industries, including the boards of Solar Enertech Corp., ThermoEnergy Corporation, Clean Power Technologies, Graphene Energy, Advanced Hydro, Inc., Gravity Power, Aerofarms, and Energy Focus, Inc.

David Gelbaum: Philanthropy

David Gelbaum gave $200 million to the Sierra Club, and $250 million to the Wildlands Conservancy - a land trust Gelbaum co-founded that has acquired and preserved 1,200 square miles of land in California, including more than a half million acres of the Mojave Desert. David Gelbaum notably gave $93 million to the American Civil Liberties Union. Some of his biggest donations, around $250 million, has gone to aid American veterans of the wars in Iraq and Afghanistan through a charity he founded, the Iraq Afghanistan Deployment Impact Fund (IADIF).

David Gelbaum signed the The Giving Pledge in 2013.

It was revealed in a Bloomberg exposé that David Gelbaum, along with two other partners of investment firm TGS Management, had quietly given over $13 billion to charitable causes over the previous two decades, using a web of trusts and private companies to hide their identities.

Andrew Jay Shechtel, Cofounder

Source: Andrew Shechtel | local copy, 2021-08-31

Andrew Shechtel is a hedge fund manager and a co-founder of the major center-left funder Wellspring Philanthropic Fund (formerly "Matan B'Seter Foundation").

Andrew Shechtel: Early Life and Career

Andrew Shechtel: Princeton Newport Partners

Andrew Shechtel lived in 1975-1976, in Bowie, Prince George's County, Maryland, United States. [source]

Andrew Jay Shechtel is an alumnus of Johns Hopkins University [local copy] and graduated with a degree in math and political economy at the age of 19. Shechtel attended Harvard Business School and reportedly "worked on Wall Street" and joined Princeton Newport Partners in the 1980s, an early investment management firm. Andrew Shechtel was an employee of the firm when it was raided in the 1990s by federal officials investigating alleged violations of the Racketeer Influenced and Corrupt Organizations (RICO) Act. Shechtel was not charged. The five partners of Princeton Newport Partners were "indicted on racketeering and tax-fraud charges," but all charges were eventually dropped.

Andrew Shechtel: TGS Management

The three founders of Wellspring were partners in the hedge fund TGS Management; C. Frederick Taylor is specifically listed as the firm's co-founder beginning in 1989. TGS is reportedly an acronym named for Wellspring founders Frederick Taylor, David Gelbaum, and Andrew Shechtel.

In June 2017, a report in the school-run business paper Princeton Info identified TGS as the "secretive successor" to the failed firm Princeton Newport Partners.

Andrew Shechtel: Personal Life and Philanthropy

A 2015 report in the school-run business paper Princeton Info noted that Andrew Shechtel and his wife, Raquel, live in New Jersey. In 2015, he was reportedly the 3rd-wealthiest resident of New Jersey, with an estimated net worth of $5 billion; during a "multi-year period," Shechtel gave away nearly $5 billion, leaving his resulting net worth at $125 million.

Shechtel's philanthropy is the Ricky and Andrew Jay Shechtel Philanthropic Fund, which largely funds the Jewish Community Youth Foundation, a project of the Jewish Family & Children's Service of Greater Mercer County (in New Jersey). The Shechtel Fund is maintained at the Jewish Communal Fund, a major donor-advised fund (DAF) provider.

C. Frederick Taylor, Cofounder

Source: [Orange County Business Journal, OCBJ.com, 2020-05-14] C. Frederick 'Fred' Taylor | local copy, 2021-08-31

C. Frederick "Fred/Freddy" Taylor reportedly worked at Princeton Newport Partners, until it was liquidated following an investigation under the Racketeer Influenced and Corrupt Organizations (RICO) Act in the 1990s. It's unclear when Taylor worked for the company.

Fred Taylor founded a quant hedge fund with partners David Gelbaum and Andrew Jay Shechtel in 1989. Develops quantitative trading systems software. Founders have funneled billions to charity. Personally gives to human rights, education, Africa. Has been on Business Journal OC's Wealthiest list with estimated wealth of $1 billion. Offices in Irvine and Princeton, N.J.

John Reid Taylor, Cofounder, President

Source: WPFund.org, 2021-08-31.

John Reid Taylor (President) co-founded the Wellspring Philanthropic Fund in 2000 with his brother William Myles Taylor, and currently manages the New York City office.

Prior to Wellspring Philanthropic Fund, John Taylor was a litigator with the Philadelphia law firms of Dechert, Price & Rhoads (1986-1989) [now Dechert LLP], Berger Montague (1989-1997), and Sandals, Langer & Taylor, LLP (1997-2000) [now Sandals & Langer, LLP].

John Taylor has served on the boards of directors of the Center for Lesbian & Gay Civil Rights [now: Equality Advocates Pennsylvania | see also >> website >> Equality Pennsylvania], the Attic Youth Center, the Planned Parenthood Foundation [Planned Parenthood Federation of America, Inc.], Survivor Corps [formerly: Landmine Survivors Network], Human Rights Watch, Haverford College, Nine Dots Learning Center [9 Dots | see also], and The Little Market. John Taylor has also served on the Steering Committee of the International Human Rights Funders Group [now: Human Rights Funders Network | internet archive snapshot, 2016-03-04], and the advisory committee of Peripheral Vision International [webpage].

William Myles Taylor, Cofounder, Vice President

Source: WPFund.org, 2021-08-31.

William Myles Taylor (Vice President) co-founded the Wellspring Philanthropic Fund in 2000 with his brother John Taylor, and currently manages the Washington, D.C., office.

Prior to Wellspring Philanthropic Fund, Myles Taylor worked for 20 years in Washington's commercial real estate industry. Myles Taylor has served on the boards of directors for the Audubon Society of the Mid-Atlantic, and the Lincoln Group of the District of Columbia, where he also served as president.

Jeanne Haws, Chief Operating Officer

Source: WPFund.org

Jeanne Haws provides (Chief Operating Officer) leadership and management of the administrative operations at the Wellspring Philanthropic Fund, consisting of the legal, financial, human resources, internal/external communications, administrative, information technology, and grants management functions.

Prior to joining Wellspring Philanthropic Fund in April 2009, Jeanne Haws served for 3 years (2006-2009) as the Associate Dean for Operations at the Princeton University's School of Public and International Affairs. For 19 years prior to that, Jeanne Haws worked in various capacities at EngenderHealth, an international women's health organization, ending her tenure as Vice President for Operations.

In addition, Jeanne Haws served on the board of trustees of World Neighbors, in Oklahoma City, from 2000 to 2007 and was a board member of InsideNGO from 2005 to 2010 [in 2017 InsideNGO merged with LINGOs, and Mango to form Humentum]. Jeanne Haws joined Philanthropy New York in 2009; she was a board member from 2015-2021 (serving as Treasurer from 2018-2021), and was co-chair of its Foundation Administrator's Network in 2011.

Jackie Williams Kaye, Chief Learning & Evaluation Officer

Source: WPFund.org, 2021-08-31.

Jackie Williams Kaye (Chief Learning & Evaluation Officer) joined the Wellspring Philanthropic Fund in October 2010. Jackie Williams Kaye currently supports Wellspring leadership, program staff, and grantees in implementing useful evaluation and research methodologies to inform and learn from grantmaking strategies.

Jackie Williams Kaye spent the first phase of her career as a researcher and program evaluator focused on public health, education, and other human service areas. In recent years, Jackie Williams Kaye has helped lead an effort within philanthropy to improve evaluation of the effectiveness of advocacy and policy change work.

Prior to joining Wellspring Philanthropic Fund, Jackie Williams Kaye spent 10 years integrating evaluation and learning into grantmaking at The Edna McConnell Clark Foundation, and then at The Atlantic Philanthropies.

Board of Trustees

Source for this subsection: InfluenceWatch.org.

The Wellspring Philanthropic Fund's articles of incorporation from 1999 list three Trustees: Allen B. Levithan, George J. Mazin, and Kenneth J. Slutsky [Partner at Lowenstein Sandler LLP].

Allen B. Levithan, the incorporator, is faculty with Rutgers Law School in New Jersey. Allen B. Levithan is also listed as Of Counsel for the law firm Lowenstein Sandler LLP. [Update: deceased, 2019.]

George J. Mazin is a retired partner with Dechert LLP, an investment management firm.

Kenneth J. Slutsky [local copy, 2021-09-01] is a New Jersey-based partner with Lowenstein Sandler LLP, a law firm that filed Wellspring Philanthropic Fund's initial articles of incorporation. | Kenneth J. Slutsky is also the President and Treasurer of the CHDI Foundation, a United States-based non-profit biomedical foundation that aims to "rapidly discover and develop drugs that delay or slow the progression of Huntington's disease",[4] a neurodegenerative genetic disorder that affects muscle coordination and leads to cognitive decline.

Wellspring Philanthropic Fund's most recent Internal Revenue Service filing covering 2017 lists Allen Levithan and Kenneth Slutsky as Trustees, as well as John L. Berger [local copy, 2021-09-01]. John Berger is a New Jersey-based Partner at Lowenstein Sandler LLP.

Adam Barber [local copy, 2021-09-01] was Controller of Wellspring Advisors, the for-profit firm associated with the foundation, from 2010 to 2017. Adam Barber is a financial analyst who previously worked for the David Lynch Foundation and Deloitte & Touche, among others.

Wellspring Philanthropic Fund: Key Staff

Source for this subsection: InfluenceWatch.org.

As of August 2019, Wellspring Philanthropic Fund has approximately 68 staffers, advisers, and consultants. Employee profiles strongly suggest that Wellspring Philanthropic Fund, the foundation, shares staffers with its associated for-profit consulting firm, Wellspring Advisors. Wellspring Philanthropic Fund's Internal Revenue Service filing for 2017 reports paying nothing ($0) in employee salaries, benefits, or other compensation.

In addition, Wellspring has posted a number of positions stressing "social justice, including racial and gender equity as an organizational operating principle," as qualifications.

Ilona Prucha [local copy, 2021-08-31] is a senior program officer for Wellspring. Prior to that, she was a program associate for Wellspring beginning in 2009 and was a U.S. House of Representatives and U.S. Senate staffer.

Laura Katzive [local copy, 2021-08-31] is a senior program officer for Wellspring, and has worked for the foundation since 2010. Prior to that, Katzive was a staffer for the Center for Reproductive Rights, a left-wing abortion advocacy group, from 1999 to 2010.

Cassandra McKee [local copy, 2021-08-31] is a Wellspring Program Officer, a position she has held since 2014. From 2012 to 2014, McKee was managing director of Fair Share, a left-wing advocacy group. From 2002 to 2012, she was a senior staffer for the advocacy group USAction. In 1997-1998, McKee was a staffer for the New Jersey Public Interest Research Group (NJPIRG).

Lesley Carson [local copy, 2021-08-31] is Director of Wellspring's International Human Rights Program. Carson is a former co-chair of the left-wing Human Rights Funders Network, founder of the advocacy training group Forefront, advisory board member for the SAGE Fund (a project of the New Venture Fund - itself incubated by and affiliated with Arabella Advisors), an ex-staffer for Amnesty International, and an ex-staffer for Sen. Patrick Leahy (D-VT).

Lesley Carson, Wellspring Philanthropic Fund; Advisory Board, SAGE Fund.

[Source]

Rebecca Fox [local copy, 2021-08-31] is a Senior Program Officer for the Sexual Orientation and Gender Identity (SOGI) program at Wellspring. Fox is a board member for Funders for Lesbian and Gay Issues, a left-wing grantmaking group. She is an alumnus of the Selah program at Bend the Arc, a left-of-center Jewish funding group.

Joyce Malombe [local copy, 2021-08-31] is a Senior Program Officer for Wellspring's International Children's Education program, a position she's held since 2012. Prior to that, she was an independent nonprofit development consultant. She also worked for the Ford Foundation, the ELMA Foundation, and World Bank. Joyce Malombe is a member of the advisory board for the Education Support program of George Soros' Open Society Foundations.

Affiliations & Associations

Wellspring Advisors

Source for the following: InfluenceWatch.org.

Contemporaneous with the creation of Matan B'Seter, Taylor and two of his brothers established Wellspring Advisors, which Philanthropy News Digest characterized as a "consulting firm for anonymous donors." For most of 2001 through most of 2017 Wellspring Advisors received $124.2 million in fees from the Wellspring Philanthropic Fund (a.k.a. Matan B'Seter), 13 percent of total contributions put into the fund during that period. In January 2018, Wellspring Advisors became an arm of the Wellspring Philanthropic Fund.

Main article: InfluenceWatch.org | local copy, 2021-08-31

Wellspring Advisors is a for-profit limited liability company (LLC) created to manage Wellspring Philanthropic Fund, a major center-left funding nonprofit. It's been described by Philanthropy News Digest as a "consulting firm for anonymous donors." The company has also been described as a "private philanthropic advisory firm."

Wellspring Advisors was created in Delaware in May 2001; its closely associated private foundation, the Wellspring Philanthropic Fund, was incorporated in New Jersey in in 1999 (though the group considers its formation year 2001).

Relationship with Wellspring Philanthropic Fund

According to its Internal Revenue Service filing for 2016, Wellspring Advisors:

... provides operational, programmatic, administrative and grantmaking support to the foundation Wellspring Philanthropic Fund. Wellspring Advisors administers the foundation's grantmaking program and interfaces with the foundation's donor-advised fund grantees ... Wellspring staff members develop the foundation's grantmaking strategy and programs, research potential recipients of advised grants from the foundation's donor-advised fund accounts, and monitor the usage of grants advised by the foundation through its donor-advised fund accounts and performance of such grantees. Wellspring also manages and supports capacity building, convenings and other similar activities to support the effectiveness of the donor-advised fund grantees.

Wellspring Advisors: Funding

Wellspring Advisors: Payments from Wellspring Philanthropic Fund

From 2001 to 2017, Wellspring Advisors received approximately $142 million in contractor fees from Wellspring Philanthropic Fund (a.k.a. Matan B'Seter Foundation). In January 2018, Wellspring Advisors became an arm of the Wellspring Philanthropic Fund.

| Payments to Wellspring Advisors |

| Source |

| 2017 | $18,954,000 |

| 2016 | $18,450,385 |

| 2015 | $16,078,000 |

| 2014 | $15,522,000 |

| 2013 | $13,886,000 |

| 2012 | $12,988,000 |

| 2011 | $11,433,854 |

| 2010 | $8,182,396 |

| 2009 | $7,830,000 |

| 2008 | $5,354,167 |

| 2007 | $4,108,333 |

| 2006 | $3,409,302 |

| 2005 | $2,103,656 |

| 2004 | $1,816,534 |

| 2003 | $1,232,944 |

| 2002 | $880,519 |

| 2001 | $426,241 |

| Total | $142,656,331 |

Wellspring Advisors: Leadership

John Reid Taylor is the managing partner of Wellspring Advisors and founder of Wellspring Philanthropic Fund. Business profiles online suggest Taylor previously worked for Berger & Montague P.C. from 1989-1997 and as a litigator for Dechert LLP from 1986 to 1989.

Wellspring Advisors: Board of Directors

According to filings with the District of Columbia, Wellspring Advisors is managed by four Governors: Adam Barber [local copy, 2021-09-01], John Reid Taylor, William Myles Taylor, and Raymond Eng.

Wellspring Advisors: Key Staff

For more information, see Wellspring Philanthropic Fund: Key Staff

Employee profiles strongly suggest that the Wellspring Philanthropic Fund, the foundation, shares staffers with its associated for-profit consulting firm, Wellspring Advisors. Wellspring Philanthropic Fund's Internal Revenue Service filing for 2017 reports paying nothing ($0) in employee salaries, benefits, or other compensation. As of August 2019, Wellspring Philanthropic Fund has approximately 68 staffers, advisers, and consultants.

Funders Committee for Civic Participation

In addition, the Wellspring Philanthropic Fund is a member of the Funders Committee for Civic Participation [local copy] (a project of the pass-through funder NEO Philanthropy), a donors' roundtable for major left-wing funders interested in affecting the 2020 United States census, redistricting efforts, and get-out-the-vote activities.

Left-of-Center Voter Engagement

Source for this subsection: InfluenceWatch.org.

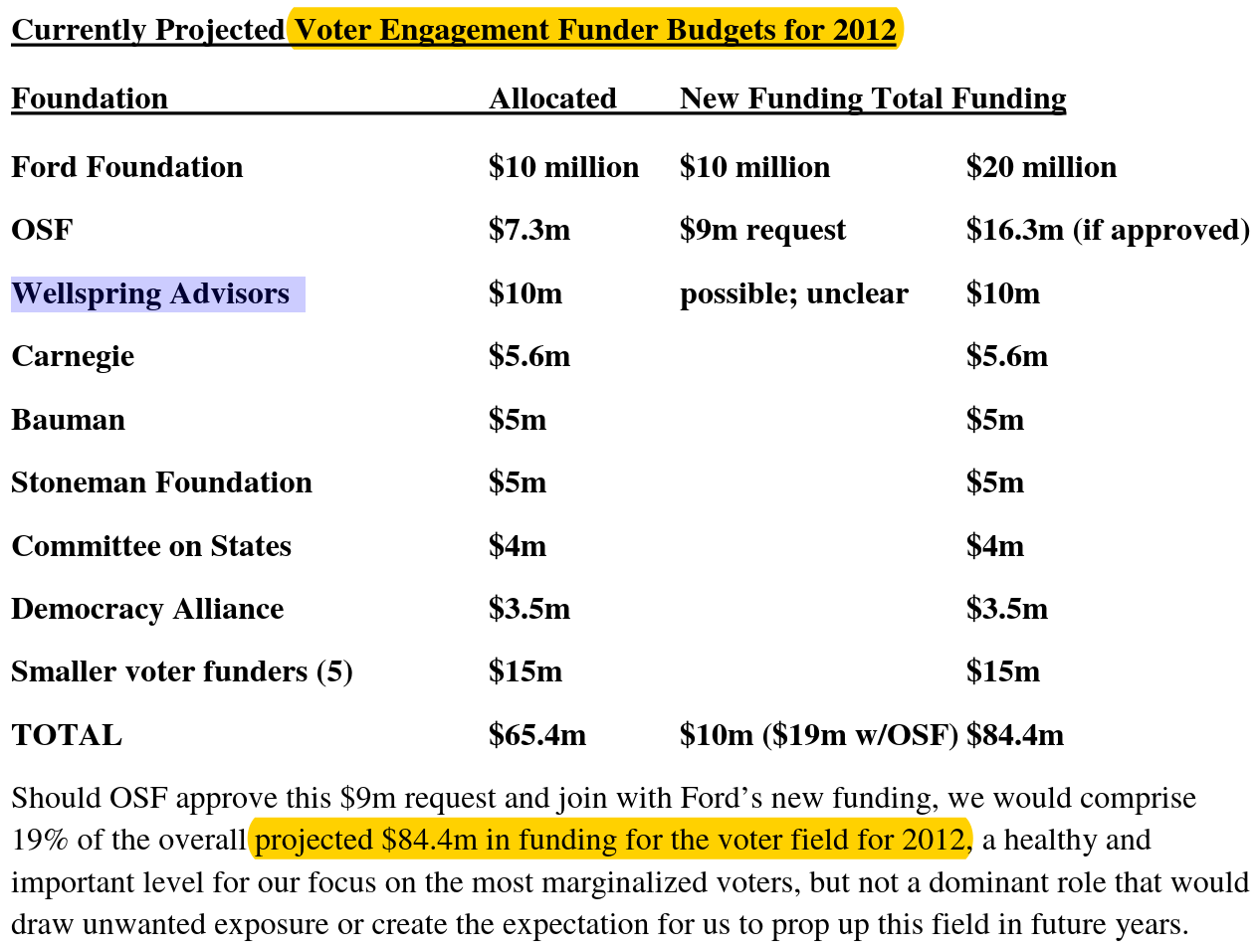

During August 2016 DC Leaks, a hacker organization widely assumed to have been a project of a Russian intelligence agency, released a trove of documents from the George Soros-backed Open Society Foundations (OSG). One of the documents is a memo to George Soros and his Open Society Foundations "U.S. Programs Board" from [now former] Service Employees International Union president Andrew L. "Andy" Stern [current President, 2021-09-01, Mary Kay Henry), and Deepak Bhargava, executive director [2012-2018] of the Center for Community Change.

The eight-page memo [local copy], titled "New Thinking on 2012 Election and Beyond," refers to a $65.4 million effort to dramatically increase voter turnout (what the document refers to with terms such as "voter engagement" and "civic engagement") among groups the two men argue will strongly support left-of-center policies. The purpose of this project proposal is identified with phrases such as "creating a long-term independent political force that can hold elected leaders of all parties accountable to open society values and priorities both before and after Election Day."

The project is presented as an ongoing collaboration of eight large left-of-center organizational donors, including Open Society Foundations (OSG), Wellspring Advisors, the Ford Foundation, Carnegie (likely the Carnegie Corporation of New York), the Stoneman Foundation (possibly the Stoneman Family Foundation), the Democracy Alliance [seeks to increase voter engagement among people of color, women, and young people], and the Committee on States. In the memo, Andy Stern and Deepak Bhargava ask George Soros and his board to increase their contribution from $7.3 million to $16.3 million.

The anticipated contribution from Wellspring Advisors to the project is listed at $10 million. (This is presumably meant as a reference to what was then the Matan B'Seter Foundation, then paying Wellspring Advisors millions of dollars each year to manage the giving hidden behind donor-advised funds). The memo also reports on a 2011 collaboration between the Open Society Foundations and Wellspring involving "highest quality voter lists" that had achieved a "tremendous, positive impact" in the realm of "voter engagement," "voter registration," and "getting out the vote in the all-important 2012 election" [2012 United States elections].

The involvement of the Wellspring Philanthropic Fund (a.k.a. Matan B'Seter Foundation) in these 2011 and 2012 projects cannot be verified because of Wellspring Philanthropic Fund's habit of concealing donations behind donor-advised funds. However, subsequent and specific late-2016 and 2017 grants reported by Wellspring Philanthropic Fund to the Internal Revenue Service reveal millions of dollars donated to left-of-center advocacy organizations for "voter engagement" and related areas.

Some of the larger examples included:

Deepak Bhargava's Center for Community Change received $300,000 for a "community engagement research project."

NEO Philanthropy received three grants totaling $1,175,000 for a "independent civic engagement report," "support for non-partisan civic engagement," and "non-partisan civic engagement by Asian-American Pacific Islander communities."

The New Venture Fund [Arabella Advisors] received four grants totaling $2 million for "non-partisan election system reform efforts," "supporting an accurate 2020 United States Census," and "non-partisan civic engagement."

Demos received two grants totaling $450,000 for a "freedom to vote elections systems reform project" and general operating support.

The Analyst Institute received $300,000 for a "civic engagement research hub project."

Connections to the Left

Source for this subsection: InfluenceWatch.org.

Representatives from Wellspring Philanthropic Fund have appeared at various events and functions alongside representatives from other major left-of-center foundations. In February 2018, Wellspring Program Director Dr. Michael Gibbons [Scholar in Residence at the School of Education for 2020-2022 at American University | local copy, 2021-09-02] spoke at an event hosted by the Global Partnership for Education in Dakar, Senegal alongside George Soros' Open Society Foundations, and the Bill and Melinda Gates Foundation.

At least one Wellspring program associate, Caroline Brazill [in 2017: Program Assistant, Atrocities Prevention & Response Program, Wellspring Advisors, LLC source | position description | local copy | American University alumnus | local copy], has facilitated workshops for the Peace and Security Funders Group (PSFG), a donors collaborative associated with the left-wing 501(c)(3) foundation that pools contributions from individuals, families and foundations." href="https://en.wikipedia.org/wiki/Ploughshares_Fund">Ploughshares Fund.

Funding

Sources for this subsection: InfluenceWatch.org | ProPublica.org

Financial Overview

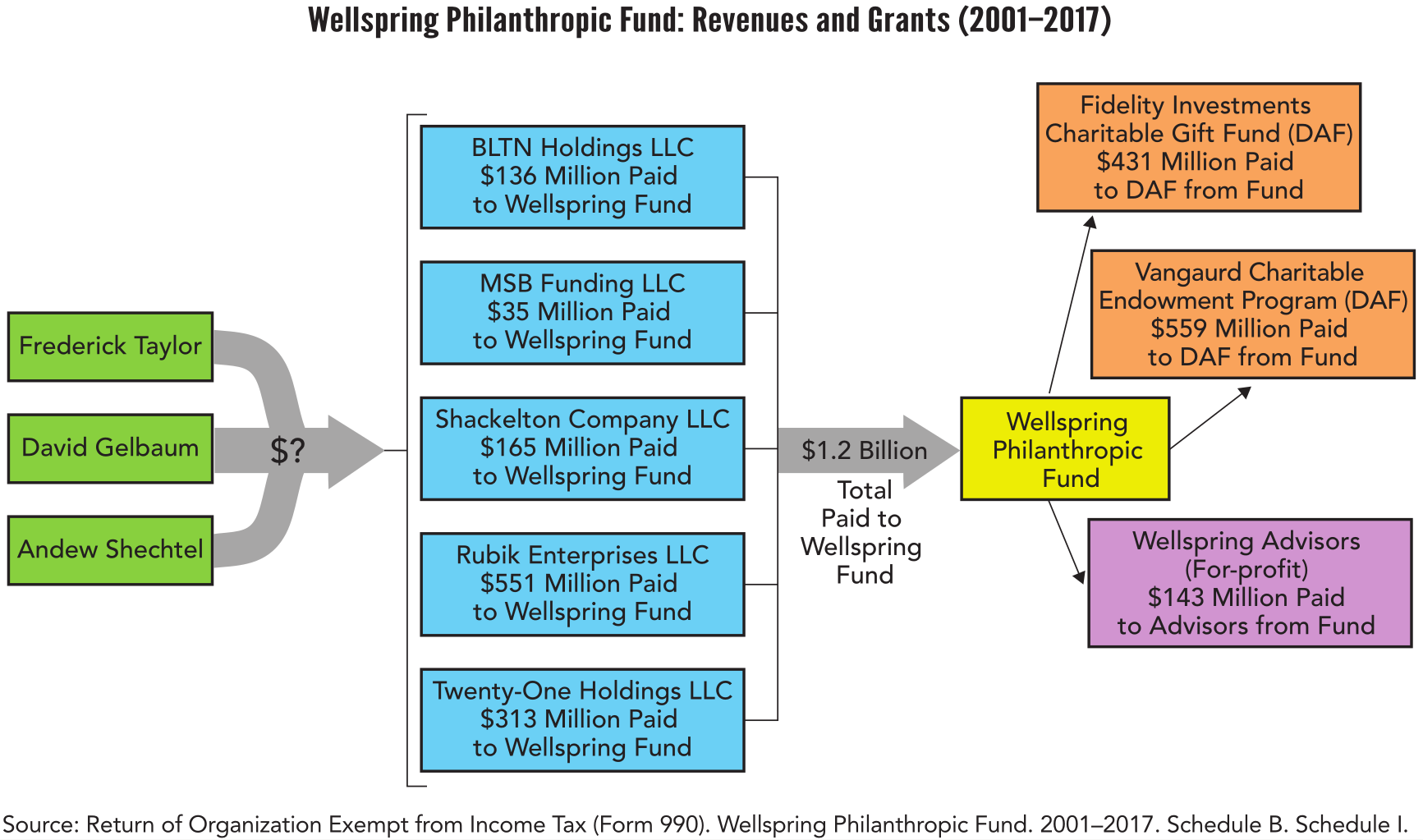

Internal Revenue Service records representing most of 2001 through most of 2017 filed by the Wellspring Philanthropic Fund (previously the Matan B'Seter Foundation) show all new money put into the fund coming from five corporate sources:

Twenty-One Holdings, LLC, c/o Lowenstein Sandler LLP. Twenty-One Holdings, LLC company Number: 5081539 | Incorporation date: 2011-12-16 | Company type: limited liability company | Jurisdiction: Delaware, USA. Note: one of numerous variations of this company (multiple states, jurisdictions ...).

Rubik Enterprises, LLC, c/o Lowenstein Sandler LLP

BLTN Holdings, LLC, c/o Lowenstein Sandler LLP

Shackleton Company, and

MBS Funding.

[From the article cited in the graphic caption, above]

... Since 2001, all of the $1.2 billion in contributions to Wellspring Philanthropic Fund have come from five privately held limited liability companies (LLC) with obscure names like BLTN Holdings, and MBS Funding.

Between 2001 and 2017, Wellspring's contributions grew from nearly $2.1 million to $254 million - an annual increase of 12,000 percent in 16 years.

Almost no information about these LLCs is publicly available. From 2001 to 2017, they consistently gave Wellspring large sums of cash. In 2011 BLTN Holdings donated a whopping $32 million in New York Stock Exchange-listed equity securities and in 2017 gave it another $9.4 million in Facebook and Netflix shares.

It's a reasonable assumption that these five companies are shell corporations created to mask the identities of Wellspring's true contributors - Andrew Jay Shechtel, Taylor, and David Gelbaum - since the companies were formed in Roseland [New Jersey] around the same time as Wellspring itself. None appear to have any websites or employees. This also means it's impossible to determine how much each of the men gave to Wellspring.

Complicating things further, prior to 2017 Wellspring only made grants through donor-advised fund (DAF) providers - specifically two associated with major investment firms, Fidelity Investments Charitable Gift Fund ["Fidelity Charitable"], and Vanguard Charitable Endowment Program. (Fidelity Charitable is the largest DAF provider in the United States.)

A DAF is a kind of charitable savings account run by a 501(c)(3) nonprofit. Donors - individuals, for-profits, or other nonprofits - gift money to the provider, which manages the funds until directed by the donor to grant it to another 501(c)(3) nonprofit. It's a useful tool for many modest philanthropists to maximize their charity, with the added benefit of withholding their identity from public disclosure, since the money passes through a third party (the provider). Donor-advised funds have been criticized - particularly by those on the Left - as the "black boxes of philanthropy."

If that's true, the Wellspring Philanthropic Fund is the ultimate "dark money" machine in America. ...

Media reports regarding Wellspring Advisors, the Wellspring Philanthropic Fund, and the close connection of both with C. Frederick Taylor raise the strong suspicion that Frederick Taylor is the main donor behind the five entities that have contributed to Wellspring / Matan B'Seter.

Wellspring's Donors

The Wellspring Philanthropic Fund's list of donors from 2001 to 2017 is available below.

| Wellspring Philanthropic Fund: Grantors (2001-2017). |

| a Indicates non-cash gift |

| BLTN Holdings | MBS Funding | Shackelton Company | Rubik Enterprises | Twenty-One Holdings | Annual Total |

| 2017 | $9,352,027 | --- | --- | $118,126,414 | $118,126,414 | $245,604,855 |

| 2016 | $10,000,000 | --- | --- | $103,063,173 | $103,063,173 | $216,126,346 |

| 2015 | $10,000,000 | --- | --- | $91,517,907 | $91,517,902 | $193,035,809 |

| 2014 | $12,000,000 | --- | --- | $86,501,255 | --- | $98,501,255 |

| 2013 | $10,000,000 | --- | --- | $78,926,839 | --- | $88,926,839 |

| 2012 | --- | --- | --- | $72,782,818 | --- | $72,782,818 |

| 2011 | $31,770,900 a | --- | $90,000,000 | --- | --- | $121,770,900 |

| 2010 | --- | --- | $75,000,000 | --- | --- | $75,000,000 |

| 2009 | --- | --- | --- | --- | --- | --- |

| 2008 | --- | $35,000,000 | --- | --- | --- | $35,000,000 |

| 2007 | --- | --- | --- | --- | --- | --- |

| 2006 | --- | --- | --- | --- | --- | --- |

| 2005 | $34,500,000 | --- | --- | --- | --- | $34,500,000 |

| 2004 | $4,500,000 | --- | --- | --- | --- | $4,500,000 |

| 2003 | --- | --- | --- | --- | --- | --- |

| 2002 | $13,897,000 | --- | --- | --- | --- | $13,897,000 |

| 2001 | --- | --- | --- | --- | --- | --- |

| | | | | | |

| Total | $136,019,927 | $35,000,000 | $165,000,000 | $550,918,406 | $312,707,489 | |

| Grand Total: | $1,199,645,822 |

Nonprofit Information

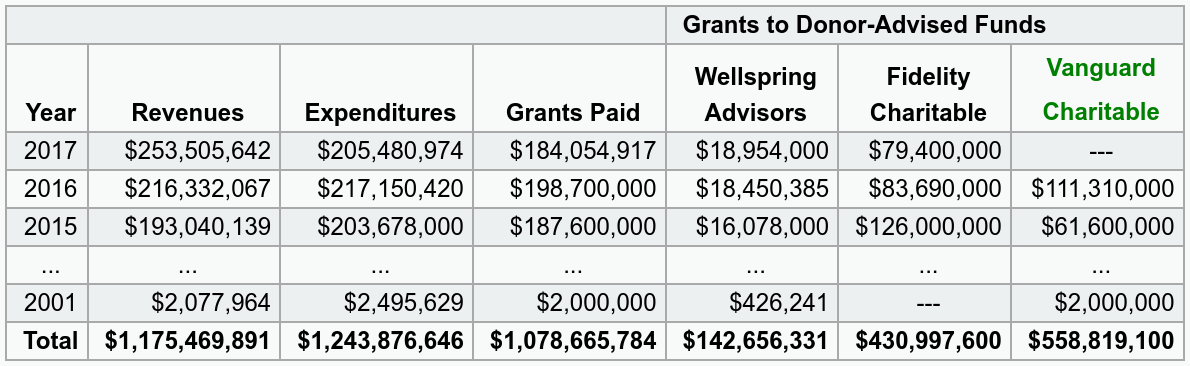

The following charts Wellspring's total revenues, total expenditures, grants paid, and net assets for the years 2001 to 2019:

| Table 1. Wellspring Philanthropic Fund: Financial Overview |

a Payments to Wellspring Advisors. IRS records representing most of 2001 through most of 2017 filed by the Wellspring Philanthropic Fund (previously the Matan B'Seter Foundation)

show the consulting firm Wellspring Advisors receiving $142 million in fees from the foundation. For more information, see Wellspring Advisors. |

b Consulting fee payments from Wellspring Philanthropic Fund to Wellspring Advisors have either either substantially decreased in 2018 and 2019, or are reported differently than in previous years.

Prior to 2018, the amounts entered at line 16c in Form 990-PF matched most or all of the amount given to Wellspring Advisors (based on descriptions elsewhere in those forms).

While line 16c amounts remain substantial in 2018 ($6,531,977) and 2019 ($7,127,140), those amounts can no longer be interpreted as payments to Wellspring Advisors. |

| c Includes $3.7 million to the Proteus Fund, a donor-advised fund (DAF). |

| Sources: InfluenceWatch.org | Nonprofit Explorer (ProPublica.org). |

| Grants to Donor-Advised Funds: |

| Year | Revenues | Expenditures | Net Assets | Payments to

Wellspring

Advisors a, b | Fidelity

Charitable | Vanguard

Charitable | Grants Paid

Annual Total | % of Total

Annual Grants |

| 2019 | $305,752,749 | $281,520,924 | $105,641,216 | --- | $22,650,000 | $20,000 | $253,591,986 | 9% |

| 2018 | $289,224,841 | $257,887,586 | $79,227,350 | $556,883 | $46,406,837 | --- | $236,057,307 | 20% |

| 2017 | $253,505,642 | $205,480,974 | $47,890,095 | $18,954,000 | $79,400,000 | --- | $184,054,917 | 53% |

| 2016 | $216,332,067 | $217,150,420 | $5,505,562 | $18,450,385 | $83,690,000 | $111,310,000 | $198,700,000 c | 100% |

| 2015 | $193,040,139 | $203,678,000 | $6,323,915 | $16,078,000 | $126,000,000 | $61,600,000 | $187,600,000 | 100% |

| 2014 | $98,524,149 | $90,522,915 | $16,961,776 | $15,522,000 | $60,000,000 | $15,000,000 | $75,000,000 | 100% |

| 2013 | $88,945,627 | $83,886,070 | $8,960,542 | $13,886,000 | $42,000,000 | $28,000,000 | $70,000,000 | 100% |

| 2012 | $72,786,294 | $77,488,000 | $3,900,985 | $12,988,000 | $29,500,000 | $35,000,000 | $64,500,000 | 100% |

| 2011 | $90,003,223 | $146,079,554 | $8,602,691 | $11,433,854 | --- | $134,645,700 | $134,645,700 | 100% |

| 2010 | $74,963,792 | $54,882,396 | $32,033,322 | $8,182,396 | --- | $46,700,000 | $46,700,000 | 100% |

| 2009 | $159,398 | $34,080,000 | $11,951,926 | $7,830,000 | --- | $26,250,000 | $26,250,000 | 100% |

| 2008 | $36,280,391 | $30,387,772 | $45,972,063 | $5,354,167 | --- | $25,000,000 | $25,000,000 | 100% |

| 2007 | $2,430,169 | $51,523,375 | $40,079,444 | $4,108,333 | --- | $47,415,000 | $47,415,000 | 100% |

| 2006 | $2,651,950 | $3,441,050 | $56,816,903 | $3,409,302 | --- | --- | $0 | --- |

| 2005 | $36,312,706 | $17,227,977 | $57,856,168 | $2,103,656 | --- | $15,000,000 | $15,000,000 | 100% |

| 2004 | $5,082,303 | $1,964,967 | $38,771,439 | $1,816,534 | --- | $140,000 | $0 | --- |

| 2003 | $912,377 | $15,141,671 | $35,851,463 | $1,232,944 | $10,407,600 | $3,398,400 | $13,806,000 | 100% |

| 2002 | $1,461,700 | $8,445,876 | $36,274,757 | $880,519 | --- | $7,500,000 | $7,500,000 | 100% |

| 2001 | $2,077,964 | $2,495,629 | $43,258,933 | $426,241 | --- | $2,000,000 | $2,000,000 | 100% |

| Total | $1,770,447,481 | $1,783,285,156 | --- | $143,213,214 | $500,054,437 | $558,979,100 | | |

IRS Form 990-PF Filings

Accounting period: starts December 01; ends November 30 (accordingly, add one to the Form 990-PF year to get the tax year covered; e.g., 2017 showing on tax form covers 2018 tax year).

Payments to Wellspring Advisors

For more information, see Wellspring Advisors (a for-profit organization).

Internal Revenue Service records representing most of 2001 through most of 2017 filed by the Wellspring Philanthropic Fund (previously the Matan B'Seter Foundation) show the consulting firm Wellspring Advisors receiving approximately $142 million in consulting fees from the foundation.

Hidden Donations

The Wellspring Philanthropic Fund has provided funding to a number of left-wing groups.

Wellspring is listed as a founding grantor to the Heartland Fund, an environmentalist donors collaborative and a project of the Windward Fund (managed by the for-profit consultancy Arabella Advisors). Other Wellspring grant recipients include the Franciscan Sisters of Mary and the Wallace Global Fund [another project of Arabella Advisors]. Wellspring is also a grantor to the left-leaning Public Policy Institute of California (PPIC); Wellspring co-funded PPIC's Research Collaborative Fund, alongside Pierre Omidyar's Democracy Fund, and the Ford Foundation. PPIC's Research Collaborative Fund is a project of the Arabella Advisors-run New Venture Fund.

Wellspring is a funding member of Philanthropy Advancing Women's Human Rights (PAWHR), a project of the pass-through funder Proteus Fund. It's also funded the LGBTQ Poverty Initiative, a research and advocacy group.

For most of 2001 through most of 2017 the Wellspring Philanthropic Fund (previously the Matan B'Seter Foundation) gave grants totaling nearly $900 million, with 88.3 percent of this money - nearly $795 million - going to two recipients: Vanguard Charitable Endowment Program, and the Fidelity Investments Charitable Gift Fund.

These very large donor-advised fund (DAF) provider invest the contributions they receive in accordance with the wishes of those giving the money. A DAF provider is not required to disclose how its donors directed the DAF to give the money away. As such the final recipients of nearly $795 million given away by Wellspring / Matan B'Seter are unknown. Prior to 2017, and with the single exception of a small in-kind gift in 2004, 100 percent what Wellspring / Matan B'Seter reports giving through 2015 - more than $715 million - was hidden behind transfers to the Fidelity Investments Charitable Gift Fund, and Vanguard Charitable Endowment Program DAFs.

A listing Wellspring's grants to donor-advised fund providers from 2001-2017 is provided in Table 1, above.

2017 Grant Recipients

Wellspring Philanthropic Fund's tax returns covering late-2016 and most of 2017 show direct donations to some final recipients. However, this increase in transparency is only partial, as 32 percent ($79.4 million) of the $245.7 million granted during the period still went into the Fidelity Investments Charitable Gift Fund DAF.

Of the named grant recipients for 2017, at least $28.5 million (11.6 percent) was given to 56 left-of-center advocacy organizations.

| 2017 Wellspring Philanthropic Fund Grant Recipients |

| Grant Recipient | Amount |

| New Venture Fund | $6,796,500 |

| Proteus Fund | $2,150,000 |

| NEO Philanthropy | $2,120,000 |

| Planned Parenthood Federation of America, Inc. (PPFA) | $1,951,387 |

| Astraea Lesbian Foundation for Justice | $1,100,000 |

| Analyst Institute | $1,000,000 |

| Advocates for Youth (AFY) | $925,000 |

| Borealis Philanthropy | $775,000 |

| Every Child Matters Education Fund | $750,000 |

| Alliance for Justice (AFJ) | $550,000 |

| State Voices | $519,000 |

| Faith In Action | $485,000 |

| Center for Constitutional Rights (CCR) | $450,000 |

| Demos | $450,000 |

| Tides Foundation | $430,000 |

| Center for Popular Democracy (CPD) | $420,000 |

| National Latina Institute for Reproductive Health | $400,000 |

| Hopewell Fund | $381,875 |

| Center for American Progress (CAP) | $370,000 |

| Center for Law and Social Policy (CLASP) | $350,000 |

| Forward Together | $350,000 |

| National Women's Law Center | $350,000 |

| Center for Community Change (CCC) | $300,000 |

| Coalition on Human Needs | $300,000 |

| Tides Center | $300,000 |

| Colorofchange.org Education Fund | $250,000 |

| Community Catalyst | $250,000 |

| MomsRising Education Fund | $250,000 |

| Project On Government Oversight (POGO) | $250,000 |

| Population Council | $220,000 |

| American Constitution Society for Law and Policy | $200,000 |

| Center for Health and Gender Equity (CHANGE) | $200,000 |

| Center for Public Integrity | $200,000 |

| Groundswell Fund | $200,000 |

| Public Citizen Foundation | $200,000 |

| Ms. Foundation for Women/td> | $197,695 |

| Campaign Legal Center | $150,000 |

| Citizens for Responsibility and Ethics in Washington (CREW) | $150,000 |

| Commonwealth Institute for Fiscal Analysis | $150,000 |

| Government Accountability Project (GAP) | $150,000 |

| Guttmacher Institute | $150,000 |

| LGBTQ Victory Institute | $150,000 |

| Bus Federation Civic Fund (i.e. Alliance for Youth Organizing) | $100,000 |

| National Domestic Workers Alliance (NDWA) | $100,000 |

| People's Action Institute | $100,000 |

| Political Research Associates (PRA) | $100,000 |

| Population Action International | $100,000 |

| Protect Democracy Project (PDP) | $100,000 |

| Public Employees for Environmental Responsibility | $100,000 |

| Ballot Initiative Strategy Center | $50,000 |

| Chicken & Egg Pictures | $39,450 |

| Colorado Civic Engagement Roundtable | $25,000 |

| Grand Total | $28,105,907 |

Donation Recipients

Advocates for Youth (AFY)

Alliance for Justice (AFJ)

American Constitution Society for Law and Policy

Analyst Institute (a for-profit organization)

Astraea Lesbian Foundation for Justice

Ballot Initiative Strategy Center

Borealis Philanthropy

Alliance for Youth Organizing

California Calls Education Fund

Campaign Legal Center

Center for American Progress (CAP)

Center for Community Change (CCC)

Center for Constitutional Rights (CCR)

Center for Health and Gender Equity (CHANGE)

Center for Law and Social Policy (CLASP)

Center for Popular Democracy (CPD)

Center for Public Integrity

Chicken & Egg Pictures

Citizens for Responsibility and Ethics in Washington (CREW)

Coalition on Human Needs

Collective Future Fund

Colorado Civic Engagement Roundtable

Colorofchange.org Education Fund

Commonwealth Institute for Fiscal Analysis

Community Catalyst

Demos

EarthRights International (ERI)

Environmental Defender Law Center

Every Child Matters Education Fund

Families USA Foundation

Fidelity Investments Charitable Gift Fund

Forward Together

LGBTQ Victory Institute (LGBTQ Victory Fund, a 527 political action committee)

Government Accountability Project (GAP)

Groundswell Fund

Guttmacher Institute (reproductive health; birth control)

Gynuity Health Projects (Gynuity Institute)

Highlander Research and Education Center

Hopewell Fund (affiliated with Arabella Advisors)

Institute for Nonprofit News

LGBTQ Poverty Initiative

MomsRising Education Fund

Ms. Foundation for Women

National Domestic Workers Alliance (NDWA)

National Latina Institute for Reproductive Justice (formerly: National Latina Institute for Reproductive Health)

National Women's Law Center

NEO Philanthropy

New Venture Fund

Nonprofit VOTE

Faith In Action

People's Action Institute

Philanthropy Advancing Women's Human Rights (PAWHR)

Planned Parenthood Federation of America, Inc. (PPFA)

Political Research Associates (PRA)

Population Action International (PAI)

Population Council

Project On Government Oversight (POGO)

Project South (sociological research into education and organizing projects)

Protect Democracy Project (PDP)

Proteus Fund

Public Allies (young-adult leadership development)

Public Citizen Foundation

Public Employees for Environmental Responsibility

Research Collaborative Fund

SPARK Reproductive Justice NOW

State Voices

The Heartland Fund (housed by the Windward Fund, which is managed by Arabella Advisors)

The Praxis Project

Tides Center (overseen by Tides Foundation; incubator for smaller organizations)

Tides Foundation

Vanguard Charitable Endowment Program

David Gelbaum - Funding - Sierra Club and Immigration

Source for this subsection: Sierra Club: Population and Immigration, Wikipedia, captured 2021-09-09

Immigration was historically among the most divisive issues within the Sierra Club. In 1996, after years of debate, the Sierra Club adopted a neutral position on immigration levels. As the club has shifted to the left over the years, this position was amended in 2013 to support "an equitable path to citizenship for undocumented immigrants".

Although the position of the Sierra Club has generally been favorable towards immigration, some critics of the Sierra Club have charged that the efforts of some club members to restrain immigration, are a continuation of aspects of human population control, and the eugenics movement. In 1969, the Sierra Club published Paul R. Ehrlich's book, The Population Bomb, in which he said that population growth was responsible for environmental decline and advocated coercive measures to reduce it. Some observers have argued that the book had a "racial dimension" in the tradition of the Eugenics movement, and that it "reiterated many of Osborn's jeremiads."

During the 1980s, some Sierra Club members, including Paul Ehrlich's wife Anne Howland Ehrlich, wanted to take the Club into the contentious field of immigration to the United States. The club's position was that overpopulation was a significant factor in the degradation of the environment. Accordingly, the Club supported stabilizing and reducing U.S. and world population. Some members argued that, as a practical matter, U.S. population could not be stabilized, let alone reduced, at the then-current levels of immigration. They urged the club to support immigration reduction. The club had previously addressed the issue of "mass immigration", and in 1988, the organization's Population Committee and Conservation Coordinating Committee stated that immigration to the U.S. should be limited, so as to achieve population stabilization.

Other Sierra Club members thought that the immigration issue was too far from the club's core environmentalist mission, and were also concerned that involvement would impair the organization's political ability to pursue its other objectives. In the mid 1990s, the club began gradually stepping away from the immigration restrictionist position, culminating with the board adopting a neutral position on immigration policy in 1996. In 1998, 60.1% of Sierra Club voting members voted that the organization should remain neutral on America's immigration policies, while 39.2% supported a measure calling for stricter curbs on immigration to the United States.

After the 1996 board policy adoption, some members who were advocates of immigration reduction organized themselves as "SUSPS", a name originally derived from "Sierrans for U.S. Population Stabilization", which now stands for "Support U.S. Population Stabilization." SUSPS advocates a return to the Sierra Club's "traditional" (1970-1996) immigration policy stance. SUSPS has called for fully closing the borders of the United States, and for returning to immigration levels established by the Immigration Act of 1924, which includes strict ethnic quotas. David Brower also cited the club's position shift on immigration as one of the reasons for his resignation from the board in 2000. Supporters of immigration reduction within the club also charged that the board had abandoned the restrictionist position on immigration due to donations from investor David Gelbaum, who reportedly gave $200 million to the club between the mid 1990s and early 2000s and threatened Carl Pope in the mid 1990s to cease donations if they did not change their position on immigration adopted in 1988.

The controversy resurfaced when a group of three immigration reduction proponents ran in the 2004 Sierra Club Board of Directors election, hoping to move the club's position away from a neutral stance on immigration, and to restore the stance previously held. Groups outside of the Club became involved, such as the Southern Poverty Law Center, and MoveOn. Of the three candidates, two (Frank Morris and David Pimentel), were on the board of the anti-immigration group Diversity Alliance for a Sustainable America and two (Richard Lamm and Frank Morris) were on the board of directors or the board of advisors of the Federation for American Immigration Reform; both had also held leadership positions within the NAACP. Their candidacies were denounced by a fourth candidate, Morris Dees of the SPLC, as a "hostile takeover" attempt by "radical anti-immigrant activists." The immigration reduction proponents won 7% of all votes cast in the election. In 2005, members voted 102,455 to 19,898 against a proposed change to "recognize the need to adopt lower limits on migration to the United States."

With the increased number of progressive activists joining the club in recent years, the Sierra Club has dramatically shifted its stance on immigration further towards the affirmative. Today, the Sierra Club supports a path to citizenship for undocumented immigrants, opposes a border wall and works with immigrant groups to promote environmental justice.

David Gelbaum - Funding - Sierra Club and Immigration - Additional Reading

[LATimes.com, 2004-10-27] The Man Behind the Land | local copy

[SUSPS.org, ca. 2005-06] For the love of money. | While that web page is undated, the following content first appears at the top of that page in the 2005-06-12 archive.org snapshot of http://www.susps.org (absent in 2005-05-27 shapshot). | local copy