Tax avoidance vs. tax evasion

Image source. |

| URL | https://Persagen.com/docs/wealth-tax_avoidance_and_tax_evasion.html |

| Sources | Persagen.com | Wikipedia (itemized below) | other sources (cited in situ) |

| Source URLs | |

| Date published | 2021-10-04 |

| Curation date | 2021-10-04 |

| Curator | Dr. Victoria A. Stuart, Ph.D. |

| Modified | |

| Editorial practice | Refer here | Date format: yyyy-mm-dd |

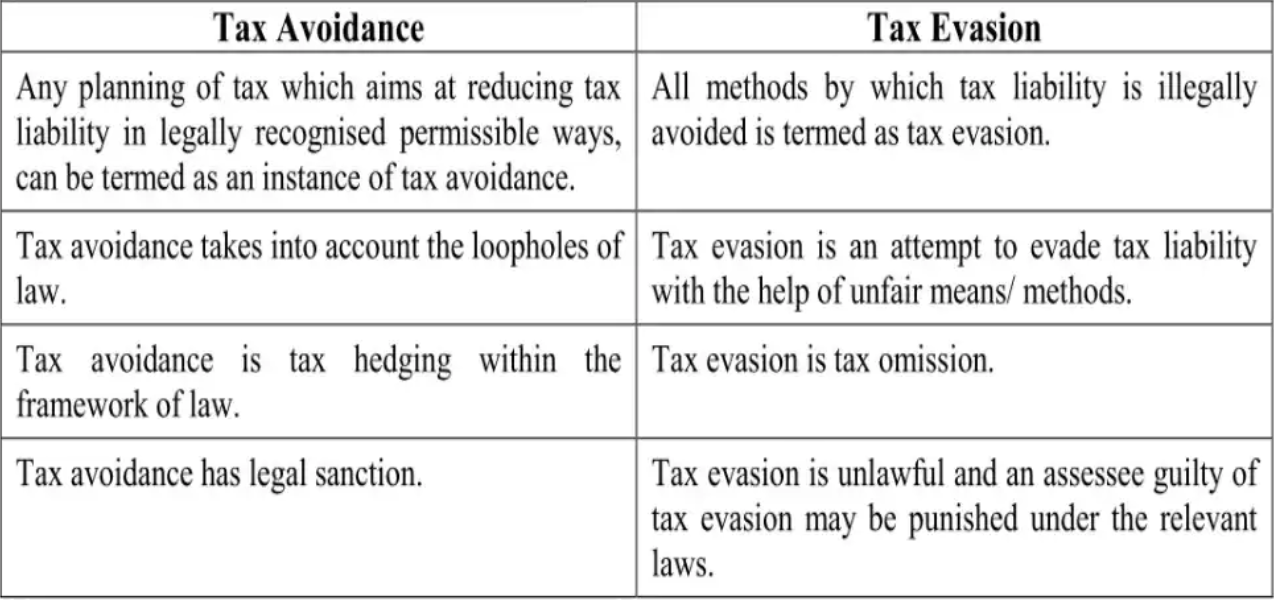

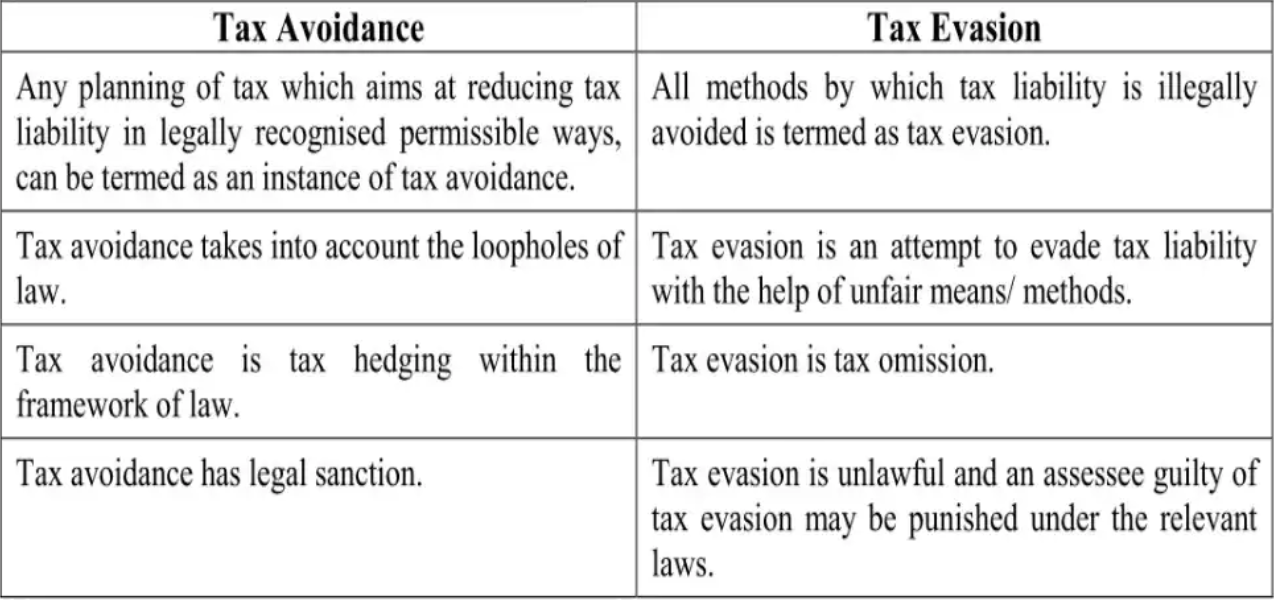

| Summary | Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of taxes that is payable by means that are within the law. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to reduce the taxpayer's tax liability. |

| Key points |

|

| Related | |

| Keywords | Show |

| Named entities | Show |

| Ontologies | Show |

Tax avoidance vs. tax evasion

Image source. |

Tax avoidance is the legal usage of the tax regime in a single territory to one's own advantage to reduce the amount of taxes that is payable by means that are within the law. A tax shelter is one type of tax avoidance, and tax havens are jurisdictions that facilitate reduced taxes.

Forms of tax avoidance that use tax laws in ways not intended by governments may be considered legal but are almost never considered moral in the court of public opinion and rarely are in journalism. Many corporations and businesses that take part in the practice experience a backlash from their active customers or online. Conversely, benefitting from tax laws in ways that were intended by governments is sometimes referred to as tax planning. The World Bank's World Development Report 2019 on the future of work supports increased government efforts to curb tax avoidance as part of a new social contract focused on human capital investments and expanded social protection.

"Tax mitigation", "tax aggressive", "aggressive tax avoidance" or "tax neutral" schemes generally refer to multiterritory schemes that fall into the grey area between common and well-accepted tax avoidance, such as purchasing municipal bonds in the United States, and tax evasion but are widely viewed as unethical, especially if they are involved in profit-shifting from high-tax to low-tax territories and territories recognised as tax havens. Since 1995, trillions of dollars have been transferred from OECD and developing countries into tax havens using these schemes.

Laws known as a General Anti-Avoidance Rule (GAAR) statutes, which prohibit "aggressive" tax avoidance, have been passed in several countries and regions including Canada, Australia, New Zealand, South Africa, Norway, Hong Kong and the United Kingdom. In addition, judicial doctrines have accomplished the similar purpose, notably in the United States through the "business purpose" and "economic substance" doctrines established in Gregory v. Helvering and in the United Kingdom in the Ramsay Principle. The specifics may vary according to jurisdiction, but such rules invalidate tax avoidance that is technically legal but is not for a business purpose or is in violation of the spirit of the tax code.

The term "avoidance" has also been used in the tax regulations of some jurisdictions to distinguish tax avoidance foreseen by the legislators from tax avoidance exploiting loopholes in the law such as like-kind exchanges. The Supreme Court of the United States has stated, "The legal right of an individual to decrease the amount of what would otherwise be his taxes or altogether avoid them, by means which the law permits, cannot be doubted".

Tax evasion, on the other hand, is the general term for efforts by individuals, corporations, trusts and other entities to evade taxes by illegal means. Both tax evasion and some forms of tax avoidance can be viewed as forms of tax noncompliance, as they describe a range of activities that are unfavourable to a state's tax system.

According to Joseph Stiglitz (1986), there are three principles of tax avoidance: postponement of taxes, tax arbitrage across individuals facing different tax brackets, and tax arbitrage across income streams facing different tax treatment. Many tax avoidance devices include a combination of the three principles.

The postponement of taxes is the present discounted value of postponed tax is much less than of a tax currently paid. Tax arbitrage across individuals facing different tax brackets or the same individual facing different marginal tax rates at different times is an effective method of reducing tax liabilities within a family. However, according to Stiglitz (1986), differential tax rates may also lead to transactions among individuals in different brackets leading to "tax induced transactions". The last principle is the tax arbitrage across income streams facing different tax treatment.

Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals, corporations, trusts, and others. Tax evasion often entails the deliberate misrepresentation of the taxpayer's affairs to the tax authorities to reduce the taxpayer's tax liability, and it includes dishonest tax reporting, such as declaring less income, profits or gains than the amounts actually earned, or overstating deductions.

Tax evasion is an activity commonly associated with the informal economy. One measure of the extent of tax evasion (the "tax gap") is the amount of unreported income, which is the difference between the amount of income that should be reported to the tax authorities and the actual amount reported.

In contrast, tax avoidance is the legal use of tax laws to reduce one's tax burden. Both tax evasion and tax avoidance can be viewed as forms of tax noncompliance, as they describe a range of activities that intend to subvert a state's tax system, but such classification of tax avoidance is disputable since avoidance is lawful in self-creating systems. Tax evasion is often an offence by an individual, while tax avoidance is often a corporate practice.

The Panama Papers (Spanish: Papeles de Panamá) are 11.5 million leaked documents (or 2.6 terabytes of data) that were published beginning on April 3, 2016. The papers detail financial and attorney-client information for more than 214,488 offshore entities. The Panama Papers, some dating back to the 1970s, were created by, and taken from, former Panamanian offshore law firm and corporate service provider Mossack Fonseca.

The Panama Papers contain personal financial information about wealthy individuals and public officials that had previously been kept private. The publication of the Panama Papers made it possible to establish the prosecution of Jan Marsalek, who is still a person of interest to a number of European governments due to his revealed links with Russian intelligence, and international financial fraudsters David Baazov and Josh Baazov. While offshore business entities are legal (see Offshore Magic Circle), reporters found that some of the Mossack Fonseca shell corporations were used for illegal purposes, including fraud, tax evasion, and evading international sanctions.

"John Doe", the whistleblower who leaked the Panama Papers to German journalist Bastian Obermayer from the newspaper Süddeutsche Zeitung, remains anonymous, even to the journalists who worked on the investigation. "My life is in danger", the whistleblower told them. In a May 6, 2016 document, John Doe cited income inequality as the reason for the action and said they leaked the Panama Papers "simply because I understood enough about their contents to realize the scale of the injustices they described". Doe added that they had never worked for any government or intelligence agency and expressed willingness to help prosecutors if granted immunity from prosecution. After Süddeutsche Zeitung verified that the statement did in fact come from the source for the Panama Papers, the International Consortium of Investigative Journalists (ICIJ) posted the full document on its website.

Süddeutsche Zeitung asked the ICIJ for help because of the amount of data involved. Journalists from 107 media organizations in 80 countries analyzed documents detailing the operations of the law firm. After more than a year of analysis, the first news stories were published on April 3, 2016, along with 150 of the documents themselves. The project represents an important milestone in the use of data journalism software tools and mobile collaboration.

The documents were dubbed the Panama Papers because of the country they were leaked from, but the Panamanian government expressed strong objections to the name over concerns that it would tarnish the government's and country's image worldwide, as did other entities in Panama and elsewhere. Some media outlets covering the story have used the name "Mossack Fonseca papers".

In October 2020, German authorities issued an international arrest warrant for the two founders of the law firm at the core of the tax evasion scandal exposed by the Panama Papers. Cologne prosecutors are seeking German-born Jürgen Mossack and Panamanian Ramón Fonseca on charges of accessory to tax evasion and forming a criminal organization.

See also: [ICIJ.org, 2021-10-03] Pandora Papers. The largest investigation in journalism history exposes a shadow financial system that benefits the world's most rich and powerful. | Offshore havens and hidden riches of world leaders and billionaires exposed in unprecedented leak. The Pandora Papers reveal the inner workings of a shadow economy that benefits the wealthy and well-connected at the expense of everyone else.

The Pandora Papers are 11.9 million leaked documents (comprising 2.9 terabytes of data) that were published by the International Consortium of Investigative Journalists (ICIJ) beginning on 3 October 2021. The news organisations of the ICIJ described the document leak as their most expansive exposé of financial secrecy yet, containing documents, images, emails and spreadsheets from 14 financial service companies, in nations including Panama, Switzerland and the United Arab Emirates, surpassing their previous release of the Panama Papers in 2016, which had 11.5 million confidential documents. At the time of the release of the papers, the ICIJ said it is not identifying its source for the documents.

Up to an estimated US$32 trillion (excluding non-monetary valuables such as real estate, art, and jewelry) may be hidden from being taxed, according to news reports.

The Paradise Papers are a set of over 13.4 million confidential electronic documents relating to offshore investments that were leaked to the German reporters Frederik Obermaier and Bastian Obermayer, from the newspaper Süddeutsche Zeitung. The newspaper shared them with the International Consortium of Investigative Journalists (ICIJ), and a network of more than 380 journalists. Some of the details were made public on 5 November 2017 and stories are still being released.

The documents originate from the legal firm Appleby, the corporate services providers Estera and Asiaciti Trust, and business registries in 19 tax jurisdictions. They contain the names of more than 120,000 people and companies. Among those whose financial affairs are mentioned are, separately, AIG, Prince Charles and Queen Elizabeth II, President of Colombia Juan Manuel Santos, and U.S. Secretary of Commerce Wilbur Ross.

The released information resulted in scandal, litigation, and loss of position for some of the named, as well as litigation against the media and journalists who published the papers.

The KPMG tax shelter fraud scandal involves allegedly illegal U.S. tax shelters by KPMG that were exposed beginning in 2003. In early 2005, the United States member firm of KPMG International - KPMG LLP - was accused by the United States Department of Justice of fraud in marketing abusive tax shelters.

Under a deferred prosecution agreement, KPMG LLP admitted criminal wrongdoing in creating fraudulent tax shelters to help wealthy clients dodge $2.5 billion in taxes and agreed to pay $456 million in penalties. KPMG LLP will not face criminal prosecution as long as it complies with the terms of its agreement with the government. On January 3, 2007, the criminal conspiracy charges against KPMG were dropped. However, Federal Attorney Michael J. Garcia stated that the charges could be reinstated if KPMG does not continue to submit to continued monitorship through September 2008.

On 29 August 2005, nine individuals, including six former KPMG partners and the former deputy chairman of the firm, were criminally indicted in relation to the multibillion-dollar criminal tax fraud conspiracy. The nine individuals named in the indictment were:

Jeffrey Stein, former Deputy Chairman of KPMG, former Vice Chairman of Tax Services, and former KPMG tax partner, a lawyer with a Master's in tax law.

John Lanning, former Vice Chairman of Tax Services, and former KPMG tax partner, a CPA (Certified Public Accountant).

Richard Smith, former Vice Chairman of KPMG in charge of Tax, a former leader of KPMG's Washington National Tax, and former KPMG tax partner, a lawyer.

Philip Wiesner, former Partner-In-Charge of KPMG's Washington National Tax and former KPMG tax partner, a lawyer with a Master's in tax law and a CPA.

John Larson, a lawyer, CPA and former KPMG Senior Tax Manager who left KPMG to form a series of entities with defendant Robert Pfaff, which entities participated in certain tax shelter transactions as the purported investment advisor.

Robert Pfaff, a lawyer, CPA and former KPMG tax partner, who left KPMG to form a series of entities with defendant John Larson.

Raymond J. Ruble, also known as R.J. Ruble, a lawyer and former tax partner in the New York, New York, office of Sidley Austin, a prominent national law firm.

Mark Watson, former Partner-in-Charge of the Personal Financial Planning division in KPMG'S Washington National Tax, and former KPMG tax partner, a CPA.

On 17 October 2005, another ten individuals were indicted on criminal conspiracy and tax evasion charges.

The four tax shelters at issue were known as BLIPS, or bond linked issue premium structure; FLIPS, or foreign leveraged investment program; OPIS, or offshore portfolio investment strategy and a variant of FLIPS; and SOS, or short option strategies.

... Highly reputed multinational accounting firm KPMG has been accused by the Canada Revenue Agency of offering tax evasion schemes as products to its clients. It alleged that the KPMG tax structures were in reality a "sham" intended to deceive the tax authorities. KPMG offered a "no tax" scheme in return for a fee of 15% and in one case before the courts, it earned $300,000 in fees. [Source: Wikipedia, 2021-10-04.]

[📌 pinned article] [ICIJ.org, 2021-10-03] Pandora Papers. The largest investigation in journalism history exposes a shadow financial system that benefits the world's most rich and powerful.

[📌 pinned article] [ICIJ.org, 2021-10-03] About the Pandora Papers. ICIJ's largest-ever investigation on the offshore world unlocks financial secrets of politicians, billionaires and the global elite.

The Pandora Papers investigation lays bare the global entanglement of political power and secretive offshore finance. Based upon the most expansive leak of tax haven files in history, the investigation reveals the secret deals and hidden assets of more than 330 politicians and high-level public officials in more than 90 countries and territories, including 35 country leaders. Ambassadors, mayors and ministers, presidential advisers, generals and a central bank governor appear in the files.

The International Consortium of Investigative Journalists [Wikipedia entry], a nonprofit newsroom and network of journalists centered in Washington, D.C., obtained more than 11.9 million financial records, containing 2.94 terabytes of confidential information from 14 offshore service providers, enterprises that set up and manage shell companies and trusts in tax havens around the globe.

The files reveal secret offshore holdings of more than 130 billionaires from 45 countries including 46 Russian oligarchs. In 2021, according to Forbes, 100 of the billionaires had a collective fortune of more than $600 billion. Other clients include bankers, big political donors, arms dealers, international criminals, pop stars, spy chiefs and sporting giants.

ICIJ shared the files with 150 media partners, launching the broadest collaboration in journalism history.

[ ... snip ... ]

[CommonDreams.org, 2021-10-12] The U.S. Has Become a Tax Haven for the Vile and the Vicious. The U.S. contribution to the global concentration of wealth, the Pandora Papers help us understand, has become frighteningly enormous.

[MichaelWest.com.au, 2021-10-08] Pandora Papers: Is the world's biggest leak the world's biggest cover-up? | discussion [2021-10-09] Hacker News

[theConversation.com, 2021-10-06] Paid millions to hide trillions: Pandora Papers expose financial crime enablers, too.

[CommonDreams.org, 2021-10-04] From Empire to Global Oligarchy, Pandora Papers Expose UK's Insidious Capitalism. In an era of global surveillance capitalism, the rich can flit around the world with their vast fortunes while the rest of us are forever trapped by borders.

[AlterNet.org, 2021-10-04] 'Biggest peddler of financial secrecy': US denounced after Pandora Papers leak.

[ICIJ.org, 2021-10-03] Offshore havens and hidden riches of world leaders and billionaires exposed in unprecedented leak. The Pandora Papers reveal the inner workings of a shadow economy that benefits the wealthy and well-connected at the expense of everyone else.

Millions of leaked documents and the biggest journalism partnership in history have uncovered financial secrets of 35 current and former world leaders, more than 330 politicians and public officials in 91 countries and territories, and a global lineup of fugitives, con artists and murderers.

The secret documents expose offshore dealings of the King of Jordan, the presidents of Ukraine, Kenya and Ecuador, the prime minister of the Czech Republic and former British Prime Minister Tony Blair. The files also detail financial activities of Russian President Vladimir Putin's "unofficial minister of propaganda" and more than 130 billionaires from Russia, the United States, Turkey and other nations.

The leaked records reveal that many of the power players who could help bring an end to the offshore system instead benefit from it - stashing assets in covert companies and trusts while their governments do little to slow a global stream of illicit money that enriches criminals and impoverishes nations.

Among the hidden treasures revealed in the documents:

[ ... snip ... ]

... Erman Ilıcak [Erman Ilicak] and the other billionaires in the Pandora Papers come from 45 countries, with the largest number from Russia (52), Brazil (15), the U.K. (13) and Israel. ...

[CBC.ca, 2021-10-03] Huge 'Pandora Papers' leak exposes secret offshore accounts of politicians, celebrities and billionaires. Canadians named in confidential files include former auto-racing and figure-skating champions.

[CTVNews.ca, 2021-10-03] Leaked records open a 'Pandora' box of financial secrets.

[NPR.orgk 2021-10-03] What the 'Pandora Papers' show about how the powerful hide money from public view.

[MotherJones.com, 2021-10-03] Largest-Ever Leak of Offshore Files Reveals the Secret Finances of Hundreds of Billionaires and World Leaders. Based on 11.9 million records, the "Pandora Papers" expose hidden holdings of global elites from Putin to Shakira.

[KyodoNews.net, 2021-10-03] 1,000 Japan firms, people named in "Pandora Papers" on tax havens.

Return to Persagen.com