Wealth Inequality in the United States

SOURCE: Wikipedia, 2020-04-28

RELATED: The Abolition of Wealth

ONTOLOGIES:

- Humanities - Visual Arts - Architecture - Persons - Matthew Soules - Works - Icebergs, Zombies, and the Ultra Thin: Architecture and Capitalism in the Twenty-First Century

- Science - Social sciences - Economics - Economic systems - Capitalism - Advocacy - Lobbying - Advocacy groups - Patriotic Millionaires

- Science - Social sciences - Law - Common law - Property law - Trust law

- Science - Social sciences - Law - Common law - Property law - Trust law - Grantor retained annuity trust

- Society - Industries - Industrials - Professional services - KPMG - KPMG tax shelter fraud

- Society - Economy - Money - Finance - Investment - Investment management - Family offices

- Science - Social sciences - Economics - Economic systems - Capitalism - Wealth

- Society - Issues - Corruption - Political corruption - Tax avoidance

- Society - Issues - Corruption - Political corruption - Tax avoidance - Panama Papers

- Society - Issues - Corruption - Political corruption - Tax avoidance - Pandora Papers

- Society - Issues - Corruption - Political corruption - Tax avoidance - Paradise Papers

- Society - Issues - Corruption - Political corruption - Tax evasion

- Society - Issues - Economic issues - Wealth disparity

- Society - Issues - Corruption

- Society - Issues - Inequality - Economic inequality - Wealth inequality - Extreme wealth - Conspicuous consumption - Veblen goods

- Society - Issues - Corruption - Corruption

- Society - Issues - Inequality - Economic inequality - Wealth inequality - Extreme wealth - Billionaires

- Society - Issues - Inequality - Economic inequality - Wealth inequality - Extreme wealth - Billionaires - Persons - Jeff Bezos

- Society - Issues - Inequality - Economic inequality - Wealth inequality - Extreme wealth - Billionaires - Persons - Sergey Brin

- Society - Issues - Inequality - Economic inequality - Wealth inequality - Extreme wealth - Billionaires - Persons - Charles Koch

- Society - Issues - Inequality - Economic inequality - Wealth inequality - Extreme wealth - Billionaires - Persons - Elon Musk

- Society - Issues - Inequality - Economic inequality - Wealth inequality - Extreme wealth - Billionaires - Undue influence

- Society - Issues - Inequality - Economic inequality - Wealth inequality - Extreme wealth - Oligarchy

- Society - Issues - Inequality - Economic inequality - Wealth inequality - Extreme wealth - Plutonomy

- Society - Issues - Inequality - Economic inequality - Wealth inequality - Extreme wealth - High-net-worth individuals

- Society - Issues - Inequality - Economic inequality - Wealth inequality - Extreme wealth - Plutonomy - Ultra high-net-worth individuals

- Society - Issues - Inequality - Economic inequality - Wealth inequality - Extreme wealth - Wealth inequality

- Society - Issues - Inequality - Economic inequality - Wealth inequality - Extreme wealth - Wealth management

- Society - Issues - Inequality - Economic inequality - Wealth inequality - Extreme wealth - Wealth management - Assets - Billionaires Row - Billionaires' Row

- Society - Labor force - Professional & Business services - Corporate services

- Society - Labor force - Professional & Business services - Corporate services - Named - Appleby

- Society - Labor force - Professional & Business services - Corporate services - Named - Asiaciti Trust

- Society - Labor force - Professional & Business services - Corporate services - Named - Estera

- Society - Labor force - Professional & Business services - Corporate services - Named - Mossack Fonseca

- Society - Politics - Political ideologies - Plutocracy

A September 2014 study by Harvard Business School declared that the growing disparity between the very wealthy and the lower and middle classes is no longer sustainable.

A 2014 study by researchers at Princeton and Northwestern concludes that government policies reflect the desires of the wealthy, and that the vast majority of American citizens have "minuscule, near-zero, statistically non-significant impact upon public policy.

Wealth inequality in the United States, also known as the wealth gap, is the unequal distribution of assets among residents of the United States. Wealth includes the values of homes, automobiles, personal valuables, businesses, savings, and investments. The net worth of U.S. households and non-profit organizations was $107 trillion in the third quarter of 2019, a record level both in nominal terms and purchasing power parity. If divided equally among 124 million U.S. households, this would be $862,000 per family; however, the bottom 50% of families, representing 62 million American households, averaged $11,500 net worth. As of Q3 2019, the bottom 50% of households had $1.67 trillion or 1.6% of the net worth, versus $74.5 trillion or 70% for the top 10%. From an international perspective, the difference in US median and mean wealth per adult is over 600%.

Wealth distribution by percentile

Just prior to President Obama's 2014 State of the Union Address, media reported that the top wealthiest 1% possess 40% of the nation's wealth; the bottom 80% own 7%. The gap between the top 10% and the middle class is over 1,000%; that increases another 1,000% for the top 1%. The average employee "needs to work more than a month to earn what the CEO earns in one hour." Although different from income inequality, the two are related. In Inequality for All-a 2013 documentary with Robert Reich in which he argued that income inequality is the defining issue for the United States-Reich states that 95% of economic gains went to the top 1% net worth (HNWI) since 2009 when the recovery allegedly started. More recently, in 2017, an Oxfam study found that eight rich people, six of them Americans, own as much combined wealth as half the human race.

A 2011 study found that US citizens across the political spectrum dramatically underestimate the current US wealth inequality and would prefer a far more egalitarian distribution of wealth.

Wealth is usually not used for daily expenditures or factored into household budgets, but combined with income it comprises the family's total opportunity to secure a desired stature and standard of living, or pass their class status along to one's children. Moreover, wealth provides for both short- and long-term financial security, bestows social prestige, and contributes to political power, and can be used to produce more wealth. Hence, wealth possesses a psychological element that awards people the feeling of agency, or the ability to act. The accumulation of wealth grants more options and eliminates restrictions about how one can live life. Dennis Gilbert asserts that the standard of living of the working and middle classes is dependent upon income and wages, while the rich tend to rely on wealth, distinguishing them from the vast majority of Americans.

A September 2014 study by Harvard Business School declared that the growing disparity between the very wealthy and the lower and middle classes is no longer sustainable.

[ ... snip ... ]

Effect on democracy

See also: Income inequality in the United States § Effects on democracy and society

As of 2020, Jeff Bezos is the richest person in the world.

A 2014 study by researchers at Princeton and Northwestern concludes that government policies reflect the desires of the wealthy, and that the vast majority of American citizens have "minuscule, near-zero, statistically non-significant impact upon public policy ... when a majority of citizens disagrees with economic elites and/or with organized interests, they generally lose." When Fed chair Janet Yellen was questioned by Bernie Sanders about the study at a congressional hearing in May 2014, she responded "There's no question that we've had a trend toward growing inequality" and that this trend "can shape and determine the ability of different groups to participate equally in a democracy and have grave effects on social stability over time."

In Capital in the Twenty-First Century, French economist Thomas Piketty argues that "extremely high levels" of wealth inequality are "incompatible with the meritocratic values and principles of social justice fundamental to modern democratic societies" and that "the risk of a drift towards oligarchy is real and gives little reason for optimism about where the United States is headed."

According to Jedediah Purdy, a researcher at the Duke School of Law, the inequality of wealth in the United States has constantly opened the eyes of the many problems and shortcomings of its financial system over at least the last fifty years of the debate. For years, people believed that distributive justice would produce a sustainable level of wealth inequality. It was also thought that a certain state would be able to effectively diminish the amount of inequality that would occur. Something that was for the most part not expected is the fact that the inequality levels created by the growing markets would lessen the power of that state and prevent the majority of the political community from actually being able to deliver on its plans of distributive justice, however it has just lately come to attention of the mass majority.

[ ... snip ... ]

Billionaires Row

See also (Wikipedia): Billionaires Row. Billionaires Row, Billionaires' Row, or Billionaire's Row is the nickname of several streets or neighborhoods throughout the world that have residences belonging to some of the world's richest people. Places known as Billionaires Row include the following neighborhoods.

Billionaires' Row (Manhattan)

Billionaires' Row is a set of ultra-luxury residential skyscrapers, constructed or in development, that are arrayed roughly along the southern end of Central Park in Manhattan, New York City. Several of these buildings are in the supertall category, taller than 1,000 feet (300 m), and are among the tallest buildings in the world. Since most of these pencil towers are built or proposed on 57th Street, the term has been used to refer to the street itself as well.

[ ... snip ... ]

See also:

Matthew Soules, Associate Professor, School of Architecture + Landscape Architecture, The University of British Columbia | local copy | Matthew Soules Architecture

[Straight.com, 2021-05-26] UBC prof Matthew Soules exposes capitalism's impact on built environment in Icebergs, Zombies, and the Ultra Thin. His new book explains why real estate has become less local and a more liquid investment in recent decades.

[Book: Matthew Soules, 2021-05-18] Icebergs, Zombies, and the Ultra Thin: Architecture and Capitalism in the Twenty-First Century.

The global financial crisis of 2008 [Financial crisis of 2007-2008] revealed the damage done by unchecked housing speculation, yet in the ensuing years, the use of architecture as an investment tool has only accelerated, heightening inequality and contributing to worldwide financial instability. We rarely consider architecture to be an important factor in contemporary economic and political debates, yet sparsely occupied ultra-thin "pencil towers" develop in our cities, functioning as speculative wealth storage for the superrich, and cavernous "iceberg" homes extend architectural assets many stories below street level. Meanwhile, communities around the globe are blighted by zombie and ghost urbanism, marked by unoccupied neighborhoods and abandoned housing developments.

In Icebergs, Zombies, and the Ultra Thin, Matthew Soules issues an indictment of how finance capitalism changes not only architectural forms, but the very nature of our cities and societies. From Ireland's devastated housing estates, to the chic luxury apartments of architect Rafael Viñoly's 432 Park Avenue [a residential skyscraper at 57th Street and Park Avenue in Midtown Manhattan in New York City, overlooking Central Park], Matthew Soules demonstrates how investment imperatives shape what and how we build. Photos and drawings of architectural phenomena that have changed the way we live make the urgency of these issues even more apparent.

Matthew Soules appears in the 2021-12-15 YouTube video, above.

Additional Reading

[Institute for Policy Studies; IPS-DC.org, 2021-10-18] U.S. Billionaire Wealth Surged by 70 Percent, or $2.1 Trillion, During Pandemic. They're Now Worth a Combined $5 Trillion. Sen. Wyden's billionaires income tax tapping those huge returns could raise big revenue to fund President Biden's Build Back Better investment plan.

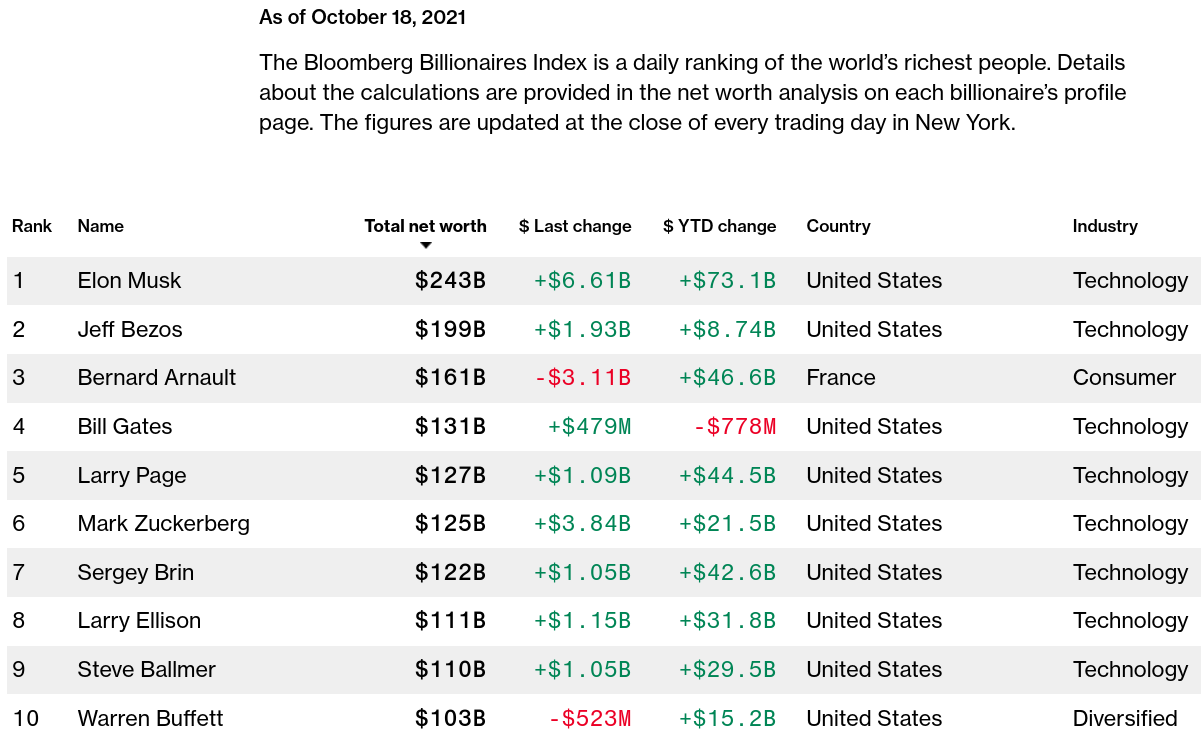

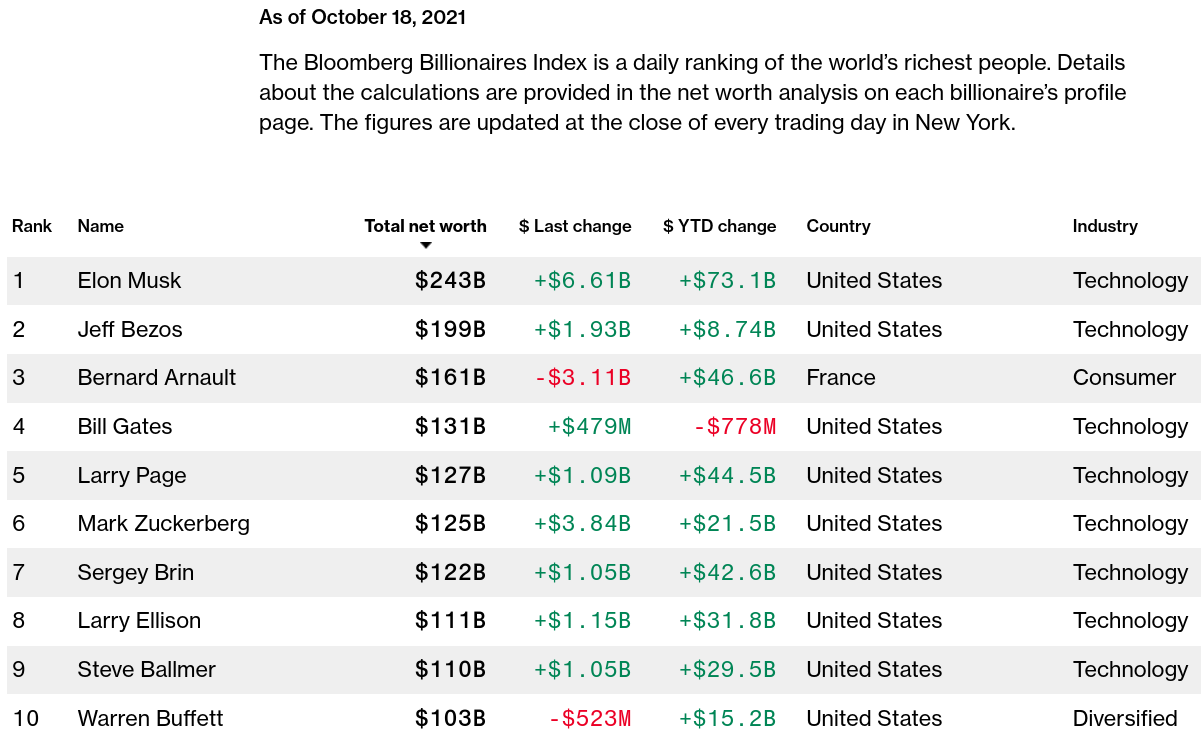

America's billionaires have grown $2.1 trillion richer during the pandemic, their collective fortune skyrocketing by 70 percent - from just short of $3 trillion at the start of the COVID crisis on March 18, 2020, to over $5 trillion on October 15 of this year, according to Forbes data analyzed by Americans for Tax Fairness (ATF) and the Institute for Policy Studies Program on Inequality (IPS). [A table of the top 15 billionaires is below.]

Not only did the wealth of U.S. billionaires grow, but so did their numbers: in March of last year, there were 614 with 10-figure bank accounts; this October, there are 745.

The $5 trillion in wealth now held by 745 billionaires is two-thirds more than the $3 trillion in wealth held by the bottom 50 percent of U.S. households estimated by the Federal Reserve Board.

The great good fortune of these billionaires over the past 19 months is all the more stark when contrasted with the devastating impact of coronavirus on working people. Almost 89 million Americans have lost jobs, over 44.9 million have been sickened by the virus, and over 724,000 have died from it.

To put this extraordinary wealth growth in perspective, the $2.1 trillion gain over 19 months by U.S. billionaires is equal to:

60 percent of the $3.5 trillion ten-year cost of President Biden's Build Back Better plan.

The entire $2.1 trillion in new revenues over ten years approved by the House Ways and Means Committee to help pay for President Biden's Build Back Better (BBB) investment plan.

Sixty-seven national organizations have sent a letter to Congress expressing concern that neither the Ways and Means committee plan nor President Biden's plan will adequately tax billionaires. They recommend Billionaires Income Tax (BIT) legislation under development by Sen. Ron Wyden, chairman of the Finance Committee, be included in final BBB legislation. It is also supported by President Biden.

Most of these huge billionaires' gains will go untaxed under current rules and will disappear entirely for tax purposes when they're passed onto the next generation. Under Wyden's BIT, billionaires will start paying taxes on their increased wealth each year just like workers pay taxes on their paychecks each year.

[ ... snip ... ]

Among the individual stories behind the big numbers:

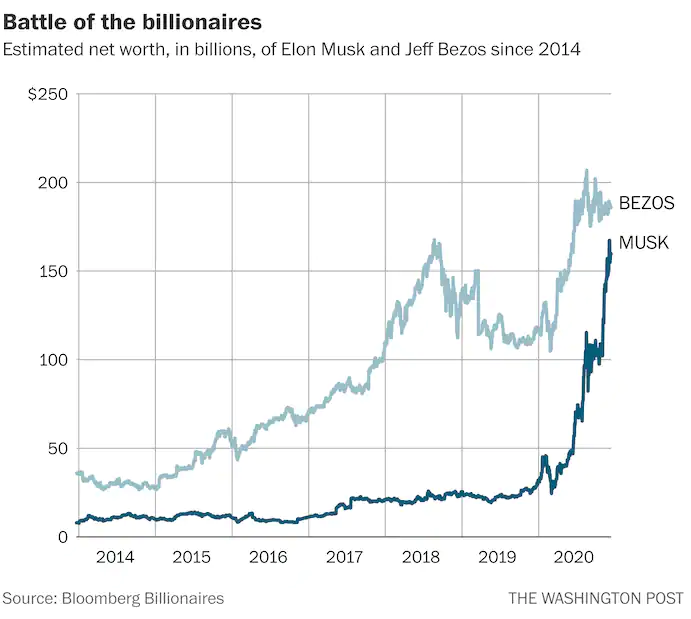

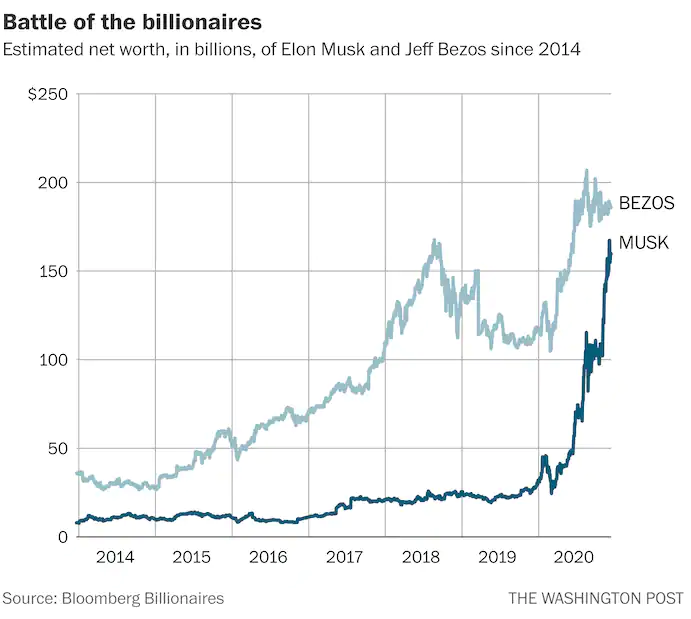

Elon Musk of Tesla and SpaceX fame is not only beating Jeff Bezos in space, he has rocketed past him in the billionaires club. Nineteen months ago, Bezos was nearly five times richer than Musk. Now, after a meteoric eight-fold increase in his wealth, Musk is worth $209 billion and Bezos $192 billion. Bezos' wealth still grew by a very large 70 percent over the period.

Google founders Sergei Brin [Sergey Brin] and Larry Page are now worth $237 billion combined, a 137 percent increase from their combined wealth of $100 billion at the beginning of the pandemic.

Nike head Phil Knight has nearly doubled his fortune from $29.5 billion to almost $58 billion. Maybe that's in part because Nike didn't pay a dime of federal income taxes in 2020 on its $2.9 billion in profits; and between 2018 and 2020 the corporation paid just a 3.3 percent tax rate on $9 billion in profits.

MacKenzie Scott, former wife of Amazon founder Jeff Bezos, saw her wealth increase $19.5 billion, or 54 percent, since the pandemic began even after giving away $8.6 billion of her wealth to charity.

[ ... snip ... ]

According to ProPublica's analysis of IRS data:

Billionaires have paid no federal income taxes in some recent years, including Jeff Bezos, Elon Musk, and George Soros.

The country's 25 top billionaires paid a tax rate of just 3.4 percent on a $400 billion increase in their collective fortune between 2014-18.

[WashingtonPost.com, 2021-01-01] World's richest men added billions to their fortunes last year as others struggled. Billionaires have added about $1 trillion to their total net worth since the pandemic began.

[Source]

[WashingtonPost.com, 2021-01-01] World's richest men added billions to their fortunes last year as others struggled. Billionaires have added about $1 trillion to their total net worth since the pandemic began.

[Source]

Bloomberg Billionaires Index, 2021-10-18

[Source]

Bloomberg Billionaires Index, 2021-10-18

[Source]

World Inequality Report 2022

Full Report | local copy

Executive Summary | local copy

Country Sheets | local copy

Wikipedia: World Inequality Report

[BusinessInsider.com, 2021-12-07] A huge study of 20 years of global wealth demolishes the myth of "trickle-down" and shows the rich are taking most of the gains for themselves. | Discussion: Hacker News: 2021-12-08

It's no secret there's inequality across the economy, but a huge new report shows just how much.

The 2022 World Inequality Report demolishes the myth that tax cuts for the rich will trickle down.

The bottom half of the global population holds just 2% of all wealth, while the top 10% earns 76%.

Wealth inequality has remained persistently high for decades, and a new report shows just how stark the divide is between the richest people and poorest people on the planet. The 2022 World Inequality Report, a huge undertaking coordinated by economic experts and inequality experts Lucas Chancel, Thomas Piketty, Emmanuel Saez, and Gabriel Zucman, was the product of four years of research and produced an unprecedented data set on just how wealth is distributed. "The world is marked by a very high level of income inequality and an extreme level of wealth inequality," the authors wrote.

The data serves as a complete rebuke of the trickle-down economic theory [trickle-down economics], which posits that cutting taxes on the rich will "trickle down" to those below, with the cuts eventually benefiting everyone. In America, trickle-down was exemplified by President Ronald Reagan's tax slashes. It's a theory that persists today, even though most research has shown that 50 years of tax cuts benefits the wealthy and worsens inequality.

The researchers are some of the leading minds on inequality in the entire field of economics. Lucas Chancel is the co-director of the World Inequality Lab, while Emmanuel Saez and Gabriel Zucman have literally written a book on the rich dodging taxes and helped create wealth tax proposals for United States Senators like Elizabeth Warren and Bernie Sanders.

Thomas Piketty, who was Gabriel Zucman's doctoral adviser, wrote the tome " Capital in the 21st Century" which used an unprecedented data set going back to the French Revolution [1789-1799] to expose how centuries of growing wealth inequality was a feature of capitalism, not a bug. The World Inequality Report was Piketty's effort to do the same for recent history.

They argue in the new report that the last two decades of wealth data show that "inequality is a political choice, not an inevitability." For instance, when it comes to wealth, which accounts for the values of assets people hold, researchers found that the "poorest half of the global population barely owns any wealth at all." That bottom half owns just 2% of total wealth. That means that the top half of the world holds 98% of the world's wealth, and that gets even more concentrated the wealthier you get.

Indeed, the richest 10% of the world's population hold 76%, or two-thirds of all wealth. That means the 517 million people who make up the top hold vastly more than the 2.5 billion who make up the bottom. The world's policy choices have led to wealth trickling up rather than down. One group in particular has seen its share of global wealth swell.

Billionaires now hold a 3% share of global wealth, up from 1% in 1995

The report notes that "2020 marked the steepest increase in global billionaires' share of wealth on record." Broadly, the number of billionaires rose to a record-number in 2020, with Wealth-X finding that there are now over 3,000 members of the "three-comma club" [i.e., billionaires: $1,000,000,000]. Billionaire gains are a well-documented trend: The left-leaning Institute for Policy Studies and Americans for Tax Fairness found that Americans added $2.1 trillion to their wealth during the COVID-19 pandemic, a 70% increase.

[ ... snip ... ]

[Truthout.org, 2022-02-17] Bernie Sanders Rips Into Billionaires for Creating “Oligarchic” Society in U.S.

On Wednesday [2022-02-17], Senator Bernie Sanders (I-VT) gave a powerful speech on the Senate floor, excoriating billionaires and CEOs for accumulating unfathomable amounts of wealth while millions of Americans struggle to get by. Since the start of the COVID-19 pandemic, millions of Americans have struggled economically, gotten ill or died - but for billionaires, "this moment has never been better," Sanders said. Because of their rapid accumulation of wealth, the country is moving toward becoming an oligarchy. "In the 1950s, when I was growing up, CEOs did very, very well. They made 20 times more than their average worker. Well, if you are a CEO, the good news is those days are long gone, when you only made 20 times more than your average workers," Sanders said. "Today, as I am sure the CEOs of this country know, they are now making 350 times more than what the average worker in America makes. Three hundred and fifty times more. Talk about greed."

While grocers like Kroger and oil and gas companies like Shell, BP, and ExxonMobil have jacked up prices for consumers, they're also making record profits and spending billions on stock buybacks, Bernie Sanders pointed out. And as the U.S. pays the highest prices in the world for prescription drugs, the CEOs of the top eight pharmaceutical companies were paid over $350 million in compensation in 2020, he went on. [theIntercept.com, 2020-03-13; Big Pharma Prepares to Profit From the Coronavirus.] Meanwhile, Wall Street has a huge influence over the economy of the country. Finance giants BlackRock Inc., The Vanguard Group, and State Street Corporation manage over $21 trillion in assets - which is larger than the gross domestic product of the United States, the largest economy in the world. CEOs and billionaires currently own a larger portion of the wealth in the U.S. than at any other point in history, Sanders pointed out.

[ ... snip ... ]

[Inequality.org, 2022-02-07] America's Inherited Wealth Dynasties Park Trillions Out of Reach of Taxation. A new report estimates that $21 trillion of that wealth will pass internally within America's already dynastically wealthy families between now and 2045.

There is an understandable focus on new wealth technology billionaires like Elon Musk and Jeff Bezos, especially as their wealth surges during the COVID-19 pandemic. But it is equally important to understand how multi-generational wealth dynasties are deploying dynasty trusts and other elaborate tax dodges to sequester trillions of dollars and dodge inheritance taxes. Wealth managers have pointed to a substantial intergenerational transfer of wealth, recently estimated at $68 trillion, as baby boomers pass on wealth to the next generations. But most of this wealth is passing within the upper canopy of the wealth forest, between the already wealthy and their heirs.

A new report, from the Americans for Tax Fairness, estimates that $21 trillion of that wealth will pass internally within America's already dynastically wealthy families between now and 2045. The report - Dynasty Trusts: Giant Tax Loopholes that Supercharge Wealth Accumulation | link to pdf | local copy - estimates that these wealthy families will avoid as much as $8.4 trillion in estate taxes and generation-skipping taxes between now and 2024, by using dynasty trusts and other currently legal loopholes (assuming current estate tax rules). "Dynasty trust" is the term for a variety of wealth-accumulating structures that remain in place for multiple generations to ensure their fortunes cascade down to children, grandchildren and beyond undiminished by wealth-transfer taxes. They typically are employed by estates of $10 million or more.

[ ... snip ... ]

[JacobinMag.com, 2022-02-06] Billionaires' Absurd and Growing Wealth Undercuts Democracy. The obscene wealth of the world's billionaires doesn't just mean they get to lead lives of luxury. It also means they have almost complete control of the economy - control that is fundamentally undemocratic and unjust.

Oxfam's most recent report on global wealth inequality [local copy] paints a grim picture of the changes that have taken place in the world economy over the course of the COVID-19 pandemic. According to research from Oxfam, the world's ten richest men doubled their wealth over the course of the past year -2021], meaning they earned the equivalent of $1.3 billion per day.

To put this figure in context, consider these illustrations of the difference between a million and a billion. If you were to count the numbers to a million it would take you twelve days; but if you were to count the numbers to a billion it would take you thirty-two years. If you were to spend a million dollars in a year, you'd have to spend roughly $2,700 per day; to spend a billion dollars in a year, you'd have to spend roughly $2.7 million per day. These ten men are now so rich that even if they lost 99.999 percent of their wealth, they'd still have more than 99 percent of people on the planet.

These numbers are so large that they're difficult to comprehend, even with illustrations. But it is extremely important that we do try to wrap our heads around the scale of inequality in the world economy right now. Because wealth inequality doesn't simply tell us about the divergent living standards and life chances of people in different tax brackets; it tells us about differences in power between the wealthy and everyone else. Billionaire wealth isn't just sitting in bank accounts accruing interest; it exists in the form of assets, like shares, property, and bonds. Many on the Right gleefully make this point when criticizing 's method for calculating wealth inequality, arguing that we shouldn't think of Jeff Bezos' wealth as equivalent to the value of his assets, because if he were to sell his assets all at once then their value would fall sharply. But this criticism misses the point. The problem with the inequality between billionaires and everyone else isn't just that they can afford to buy more stuff than everyone else; it's that they control the resources that the rest of us rely on to survive.

Take Jeff Bezos, whose wealth exists mostly in the form of Amazon shares. When measuring the scale of Jeff Bezos' wealth, we're not just looking at how rich he is - we're also looking at how powerful Bezos is. The fact that Bezos personally controls around 10 percent of one of the largest and most valuable companies in the world means Bezos has a significant amount of control over the way the economy works. Bezos can influence what wages Amazon sets, which determines the incomes of millions of people all over the world. Bezos can shape the investment decisions the company makes, which not only determine how many jobs will be created in the economy but also the kinds of goods, services, and technologies that are likely to be developed in the coming years. Bezos has input into a whole range of decisions that have a massive impact on the rest of society - from the Amazon's environmental footprint to its total tax liability.

The same can be said for other billionaires who control most of the world's resources. Property tycoons set our rents and influence land and property prices all over the world. Financiers determine where investment is allocated, which shapes all sorts of social trends, like technological change, the carbon intensity of production, and the geography of production. And media tycoons help to shape the very information we receive to understand these trends. The decisions made by this small handful of men have a huge impact on almost every area of our lives - including our wages, our rents, and the temperature of our planet [anthropogenic climate change]. And yet they exercise this extraordinary amount of power with little to no accountability.

[ ... snip ... ]

[Truthout.org, 2022-01-18] World's 10 Richest Men Doubled Their Wealth as Many Lost All During Pandemic.

[CommonDreams.org, 2021-12-07] Richest 1% Took 38% of New Global Wealth Since 1995. The Bottom Half Got Just 2%. A new report finds that global inequities in wealth and income are "about as great today as they were at the peak of Western imperialism in the early 20th century." | "If there is one lesson to be learnt from the global investigation, it is that inequality is always a political choice."

In the nearly three decades since 1995, members of the global 1% have captured 38% of all new wealth while the poorest half of humanity has benefited from just 2%, a finding that spotlights the stark and worsening gulf between the very rich and everyone else. "If there is one lesson to be learnt from the global investigation, it is that inequality is always a political choice."

That's according to the latest iteration of the World Inequality Report, an exhaustive summary of worldwide income and wealth data that shows inequities in wealth and income are "about as great today as they were at the peak of >Western imperialismglobal economic inequalities inherited from the very unequal organization of world production between the mid-19th and mid-20th centuries."

The authors of the new report, released in full on Tuesday [2021-12-07], go out of their way to stress that contemporary inequities in wealth and income are not inevitable, but rather the consequence of deliberate decisions by policymakers within individual countries and on the global stage. "The COVID-19 pandemic has exacerbated inequalities between the very wealthy and the rest of the population," said Lucas Chancel, co-director of the World Inequality Lab and lead author of the new report. "Yet, in rich countries, government intervention prevented a massive rise in poverty - this was not the case in poor countries. This shows the importance of social states in the fight against poverty." "If there is one lesson to be learnt from the global investigation carried out in this report," he added, "it is that inequality is always a political choice."

[ ... snip ... ]

[RobertReich.org, 2021-11-03] How Wealth Inequality Spiraled Out of Control.

[JacobinMag.com, 2021-10-20] U.S. Billionaires Got 70% More Wealth Under COVID. They Didn't Deserve Any of It.. New data shows that Elon Musk's fortune grew by 750% [7.5 times] during the pandemic. It's not because he worked 750% harder than the rest of us.

... newly released data from the Institute for Policy Studies offers remarkable clarity as to the scale of the billionaire class' COVID-19 windfall in America - the top-line numbers almost beggaring belief. In short, the combined wealth of the country's billionaires has risen by 70 percent since the beginning of the pandemic, jumping from just under $3 trillion to roughly to over $5 trillion as of late last week. This spike in concentrated wealth has also seen many millionaires become billionaires, with the ranks of the class as a whole swelling by 131 - from 614 in March 2020 to 745 today. To put that in perspective, as the institute's Chuck Collins notes, $5 trillion easily exceeds the $3 trillion currently held by the poorest 50 percent of America's households - meaning that well under a thousand individuals now own almost 70 percent more wealth than half the country combined.

Though many have seen their fortunes skyrocket during the pandemic, such increases have been quite unevenly distributed. Elon Musk, for example, has seen the paltry $24.6 billion he owned in March of last year grow to $209.3 billion - a spike of more than 750 percent. For comparison, the country's second-richest man, Jeff Bezos of Amazon, has added a mere $80 billion to his fortune, while Bill Gates has gained $34 billion. Whether taken together or examined in isolation, the numbers are dizzying (a full list is ), and the policy solutions are obvious. The average billionaire pays an effective federal income tax rate of only 8 percent, and, thanks to various loopholes, exemptions, and jurisdictional gaps, most billionaire wealth simply eludes taxation altogether.

[ ... snip ... ]

Jesse Walker, Stephanie J. Tepper, and Thomas Gilovich (2021-10-26) "People are more tolerant of inequality when it is expressed in terms of individuals rather than groups at the top." PNAS.DOI: 10.1073/pnas.2100430118.

Economic inequality in the developed world has increased substantially over the past several decades. During the COVID-19 pandemic, billionaires saw their wealth increase while many people struggled to meet basic needs. Redistributive policies like wealth and inheritance taxes would reduce this inequality, but broad public support for these policies is elusive. This research finds that the wealth of successful individuals may reduce support for redistribution because people are more likely to believe that the wealth of individuals, rather than groups, at the top is well earned. These findings suggest that the way inequality is presented - with either groups or individuals at the top - affects people's attributions for how wealth is earned and their tolerance of growing inequality.

Media: [ScienceDaily.com, 2021-10-18] People love the billionaire, but hate the billionaires' club. How inequality is expressed matters for policy views. Americans may respect and admire how individual billionaires - think Oprah Winfrey or Bill Gates - made their billions, even as they rage against the "top 1%" as a group, new research finds.

Return to Persagen.com